So that you’ve determined it’s time to transition from renting an condo to purchasing a home. For those who’ve at all times rented, you’re in for fairly a number of adjustments as you look to purchase. There’s a lot to maintain monitor of, from bettering your credit score rating to getting ready for surprising prices. Plus, it’s a must to handle condo bills whereas budgeting for a brand new home. Earlier than you start your journey, learn these six recommendations on shopping for a home whereas renting an condo, so that you’re as ready as you might be.

1. Finances, then store

Don’t even take into consideration home looking till you may have your funds sorted out. Many first-time homebuyers make the error of discovering a spot they love first and fascinated with their funds second. As a result of renting doesn’t construct fairness, it may be tough to economize. If cash is an impediment in your homeownership targets, examine down cost help and first-time homebuyer applications. These applications supply quite a lot of loans, grants, and credit to make shopping for your first dwelling that a lot simpler.

Earlier than homes, meet together with your financial institution to find out what rates of interest and mortgages you may afford. Then, discover a actual property agent that can assist you by means of the homebuying course of.

2. Store sensible

Be taught what inquiries to ask when shopping for a home. Though the market adjustments day-after-day, search for properties that suit your funds in areas with the facilities that you just worth. Cease by open homes to get a really feel for what you may compromise on and what’s a deal-breaker. Some objects in your want listing could fall quick in individual, whereas others could skyrocket to the highest of your listing. Attend classes or seminars on shopping for a home whereas renting an condo. Being knowledgeable is a crucial step within the homebuying course of that may set you up for achievement.

3. Get your credit score in verify for higher mortgage choices

Earlier than you begin dreaming in regards to the excellent dwelling, you might want to be sure to have a adequate credit score rating. It’s because lenders supply the perfect loans and lowest charges to prospects with wonderful credit score. For those who’re seeking to purchase a house quickly, there are methods to improve your credit score rating rapidly, comparable to cleansing up your credit score report and holding your credit score utilization under 30%. Guarantee you might be updated in your hire funds as effectively. Normally, the upper your credit score rating, the decrease your rate of interest.

4. Take the inspection critically

As a renter, inspecting the property means checking to see if the home equipment work or if there are holes within the partitions. If something main comes up, comparable to a drainage or mildew downside, the owner or property supervisor handles it.

When shopping for a home, a dwelling inspection is rather more necessary. Before you purchase a house, it’s as much as you and your house inspector to identify every part from water injury to electrical issues. While you’re shopping for a home whereas renting an condo, take your time to examine a potential dwelling totally.

Whereas a normal dwelling inspection is at all times beneficial to homebuyers, additionally take into consideration should you want some other particular inspections, comparable to a crawl house inspection or a lead-based paint inspection. These forms of dwelling inspections may also help you keep away from any unexpected points or prices, particularly if the home you’re shopping for is older or has distinctive options.

5. Consider further prices

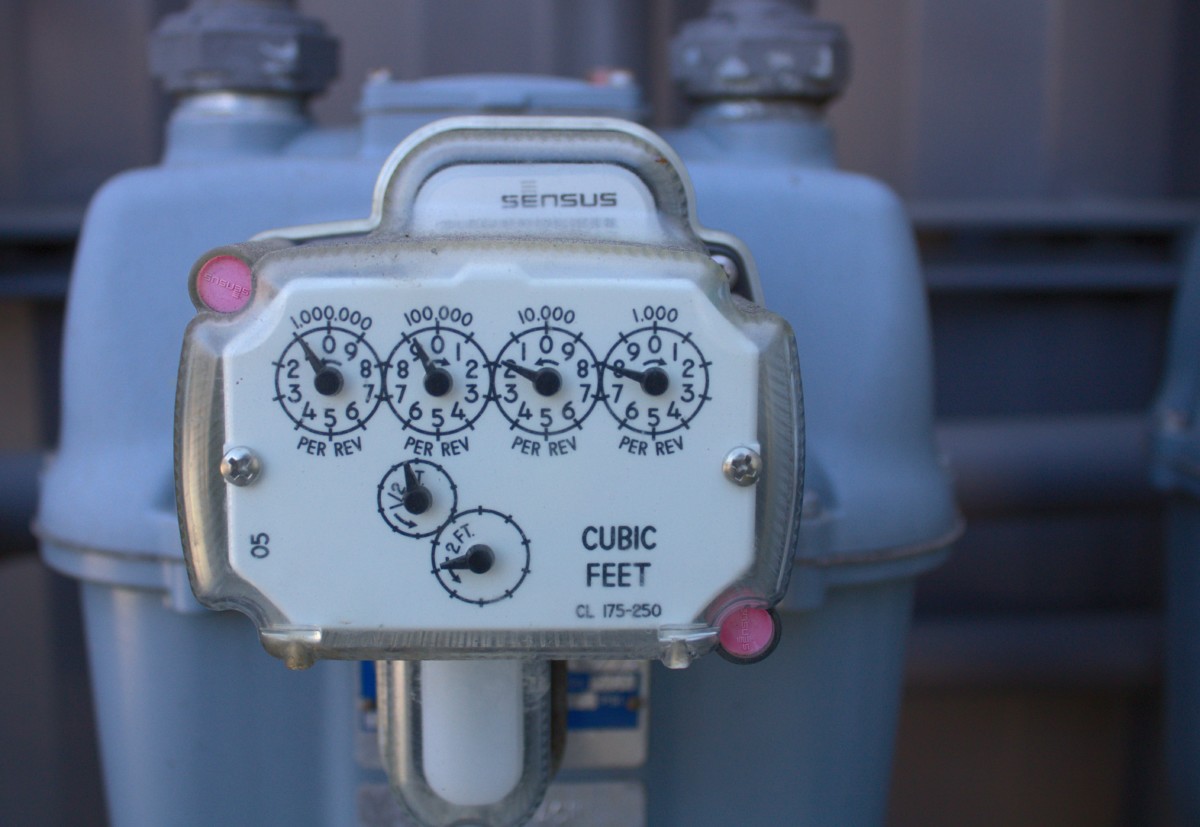

Renting an condo usually comes with customary fastened prices: water, sewer, rubbish, electrical energy, and fuel. In some instances, these utility prices are lumped into your month-to-month cost.

While you purchase a house, monitoring these prices is now your duty. This generally is a main shock when getting ready to purchase a house. As a house owner, you additionally must spend money on common upkeep to maintain your house and its programs working correctly.

While you personal a house you additionally must pay for property tax and owners insurance coverage. Property tax is a tax you pay to state or native governments primarily based on the worth of your house. Most lenders additionally require that anybody taking out a house mortgage have owners insurance coverage. The price of householders insurance coverage depends upon the placement of your house, the supplies used to construct it, and different elements as vital. In some areas, you could must buy further insurance policies comparable to fireplace or flood insurance coverage.

6. Repairs are your duty

This is likely one of the most daunting duties that differentiates homeownership from renting. Whereas landlords deal with repairs and injury in leases, as a purchaser, something that goes fallacious within the house is as much as you to repair. Your house is your sanctuary, and it’s your job to maintain it alive and livable.

To recap, be financially cheap, stability financial savings and debt, take the time to examine a property totally, ask loads of questions, and be conscious of additional prices. Whereas renting is extra handy in some instances, shopping for property is in the end a rewarding life milestone. Shopping for a home whereas renting an condo might be tough, particularly should you’re not effectively ready. Studying tips on how to do it proper saves money and time, and makes proudly owning your first dwelling that rather more rewarding.