Russia’s invasion of Ukraine since Feb. 24, mixed with persisting provide chain disruptions associated to the pandemic, proceed to drive inflation as measured by the Consumer Price Index (CPI). From a property/casualty insurance coverage perspective, these forces have a very robust affect on alternative prices – particularly within the automotive sector.

Whole P/C alternative prices characterize a weighted common for the householders, private and business auto, business multi-peril, common legal responsibility, and employees compensation strains. Auto alternative prices embody new and used automobiles, in addition to components and labor for building and restore.

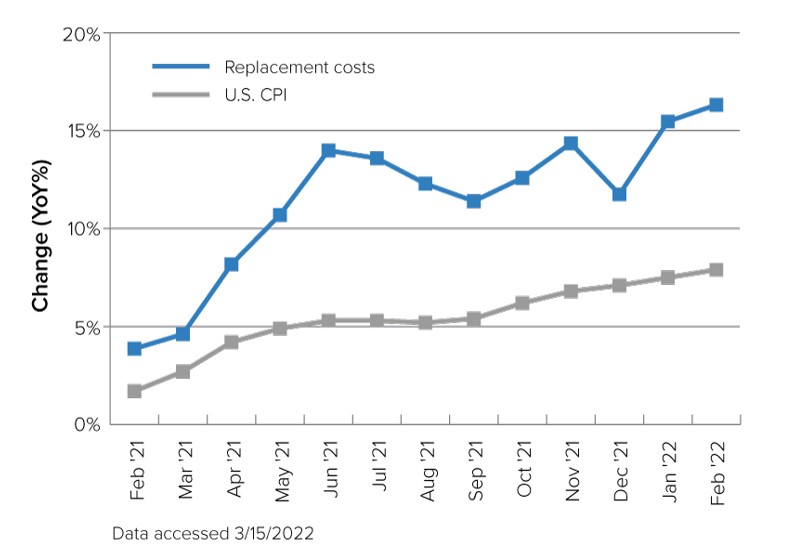

Based mostly on the March release of CPI data from the Bureau of Labor Statistics, complete P/C alternative prices rose to 16.3 p.c in February – up 4.6 p.c from 11.8 p.c in December. That enhance is 3.3 p.c higher than Triple-I projected in December, earlier than the invasion started.

Whereas CPI development is basically being fueled by rising gasoline costs stemming from uncertainty surrounding affairs in Jap Europe, the important thing driver of alternative prices is the trade’s publicity to auto costs. New-vehicle worth will increase solely broke double-digits within the fourth quarter of final yr; nevertheless, used-vehicle worth inflation has been above 25 p.c in 9 of the previous 12 months.

“Regardless of gasoline imports from Ukraine and Russia making up solely a single-digit share of U.S. power consumption, gasoline costs will doubtless stay elevated as hypothesis over OPEC exports, various gasoline sources for Central Europe, long-term profitability of home drilling operations, and rising food-insecurity in gasoline exporting counties within the Center East proceed,” mentioned Dr. Michel Léonard, Triple-I’s chief economist and information scientist and head of its Economics and Analytics Division. “On the identical time, new automobile costs will be anticipated to maintain rising as Russian exports of nickel and palladium stop.”

Russian exports of those metals – important to automotive building – account for 15 p.c and 20 p.c, respectively, of the worldwide market.

Dramatic will increase in used automobile costs are widespread throughout and after financial corrections and recessions, Léonard mentioned, including that these elevated costs often resolve themselves inside 24 months of the top of the downturn. Assuming the supply-chain scenario improves and the U.S. economic system doesn’t slip again into recession, used automobile worth development is more likely to fall again consistent with new automobile inflation over the following 12 months.