As hopeful dwelling patrons flounder in a irritating market, many are opting to hold on to rental properties in expensive areas and make a second dwelling their first dwelling buy. Because the considering goes: Shopping for in one other, cheaper market is the one path to homeownership, and this fashion they’ll preserve some rental earnings within the combine.

With summer season across the nook, we’ve turned to Vacasa, a property administration firm, for information on the profitability of rental seaside home properties in numerous U.S. locales. (The corporate additionally tracks information on lake homes and winter trip properties.)

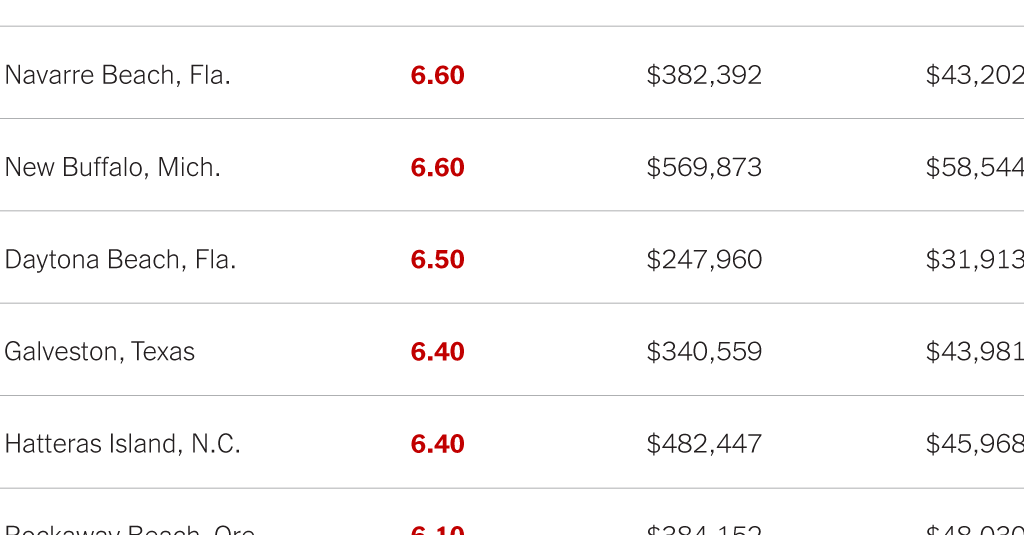

The report ranks seaside cities by capitalization price (or “cap price”), a metric used to find out the profitability of rental properties. Cap price is discovered by evaluating a house’s sale value with what stays of the annual rental income after bills are met. For instance, if a house offered for $300,000 and took in $3,000 of annual hire income after bills, the cap price can be 1 p.c. The upper the cap price, the extra worthwhile the property.

Residence gross sales and trip rental information from the previous yr had been examined utilizing precise accessible home-owner income. Vacasa’s unique information was utilized in areas the place the corporate managed at the least 50 models. Common taxes, HOA charges, utilities, insurance coverage and administration charges in every space had been subtracted from common annual rental earnings to assist discover the cap price.

Of the highest 10 most worthwhile areas, seven had been discovered to be within the South. Gulf Shores, Ala., was on the high, adopted by three cities in Florida, two in North Carolina and one in Texas.

This week’s chart exhibits the ten most worthwhile areas for seaside leases primarily based on Vacasa’s evaluation, in addition to the median dwelling value and common gross (earlier than bills) rental earnings in every.