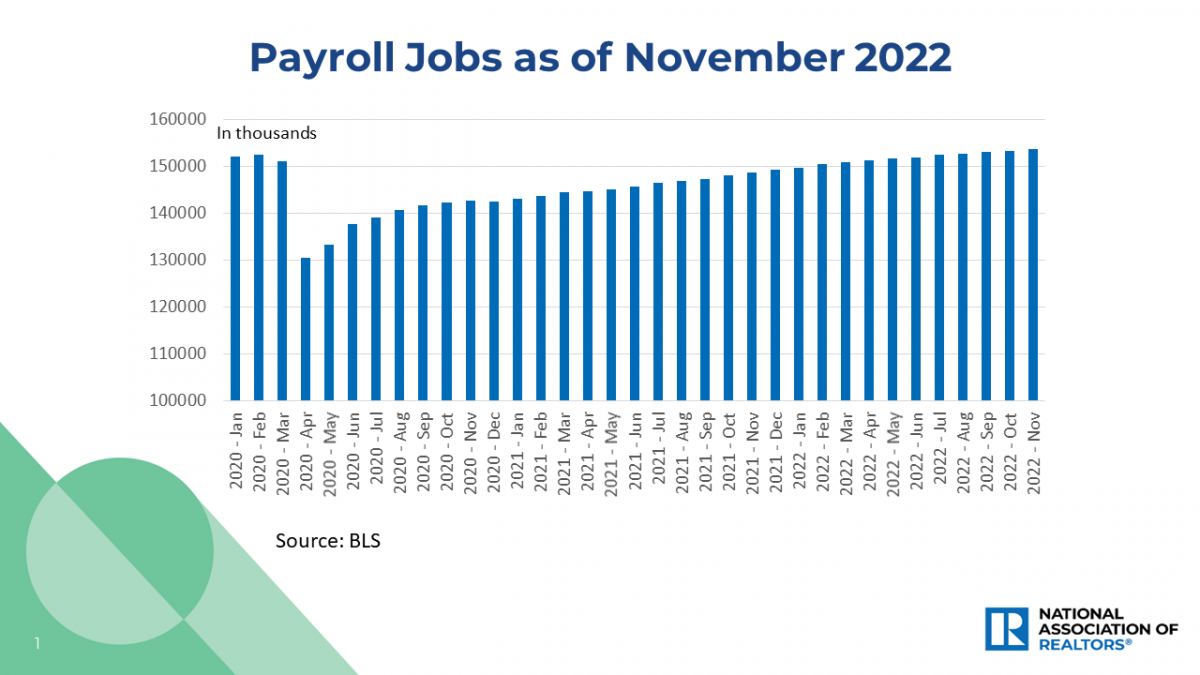

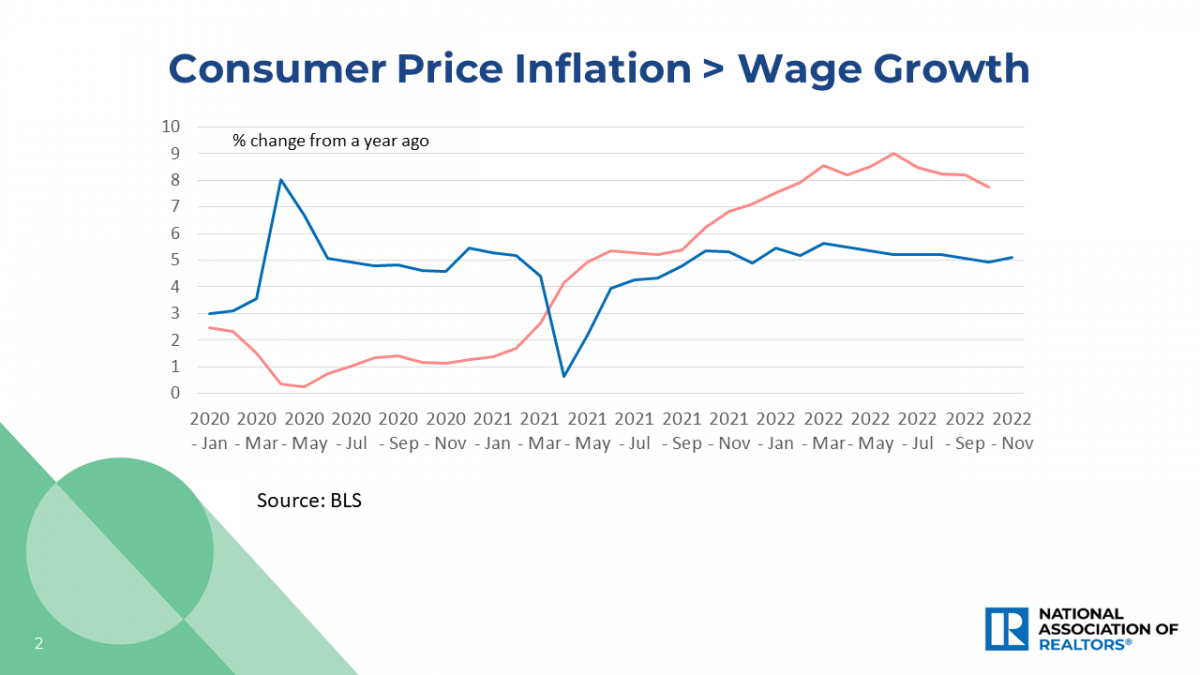

Even with the rising variety of layoffs in some industries, the general job market stays sturdy. One other 263,000 internet new payroll jobs have been added in November. The hourly wage charge grew by 5.1% from a yr in the past. The unemployment charge stays tight at 3.7%.

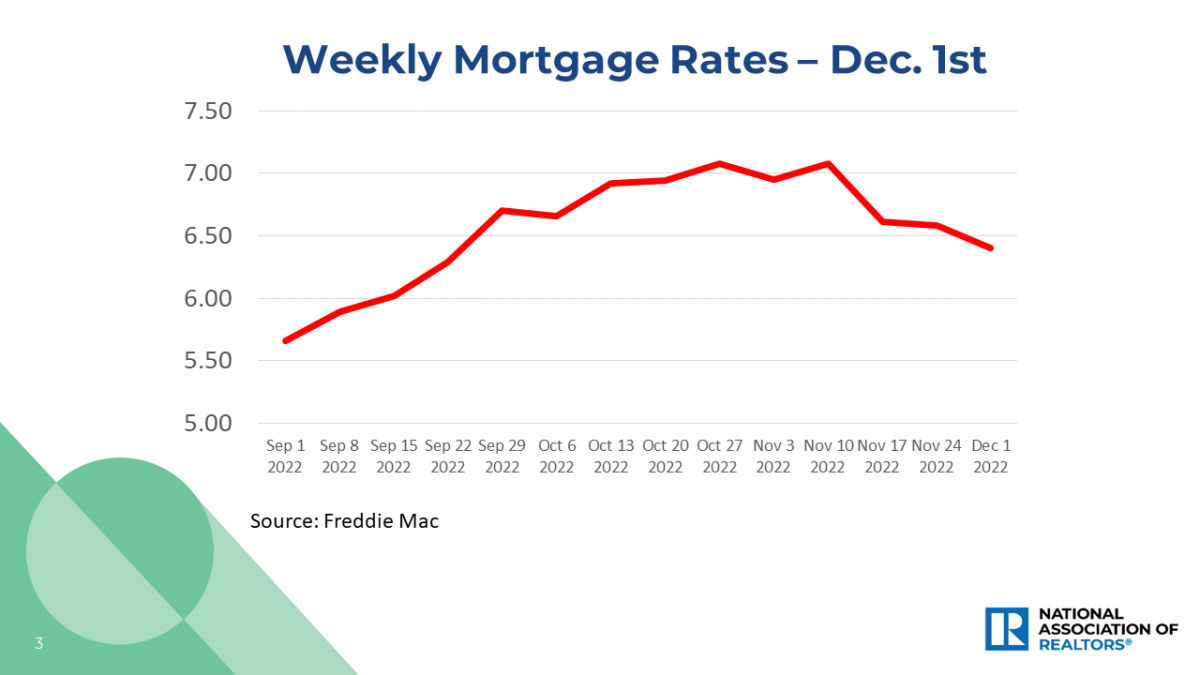

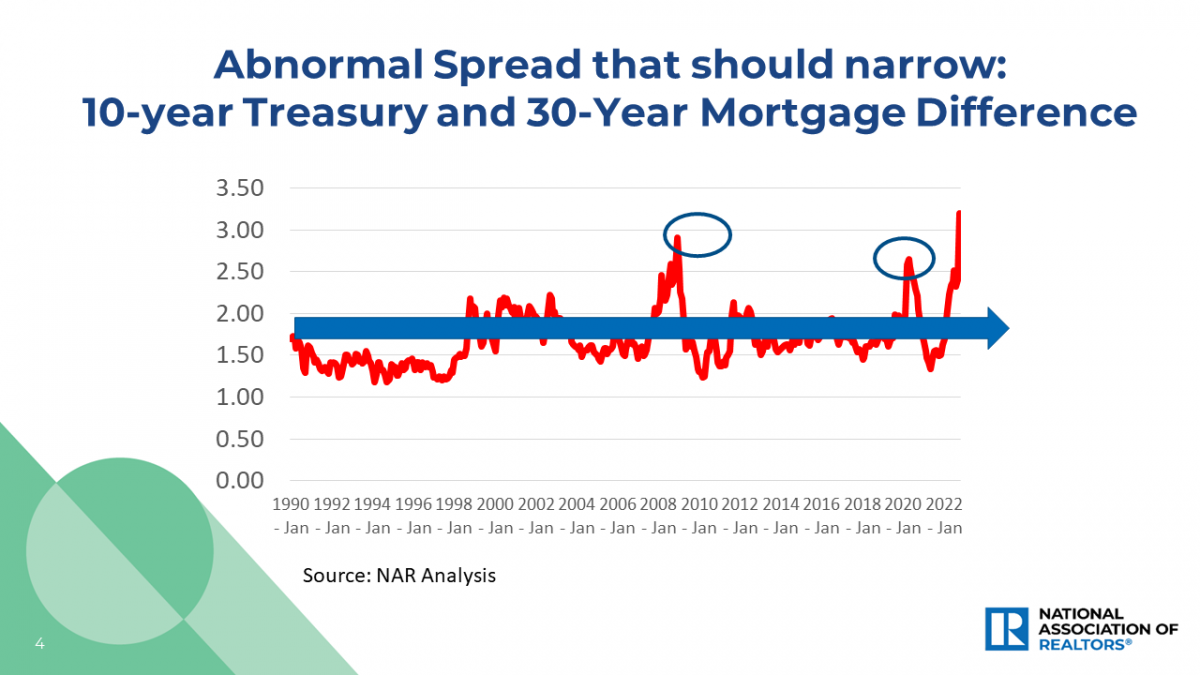

Usually, a robust job market at this section of the enterprise cycle with excessive client worth inflation would imply a extra aggressive rate of interest hike by the Federal Reserve. Nevertheless, mortgage charges have already tipped down for the third straight week, and additional declines in mortgage charges seem seemingly. The ten-year Treasury bond yield’s response to the roles information was barely destructive, with the yield rising to three.6%. That is nonetheless measurably decrease than 4.2% in early November. The 30-year mortgage charge may very well be close to 6% in a month or two (in comparison with 7% only one month in the past).

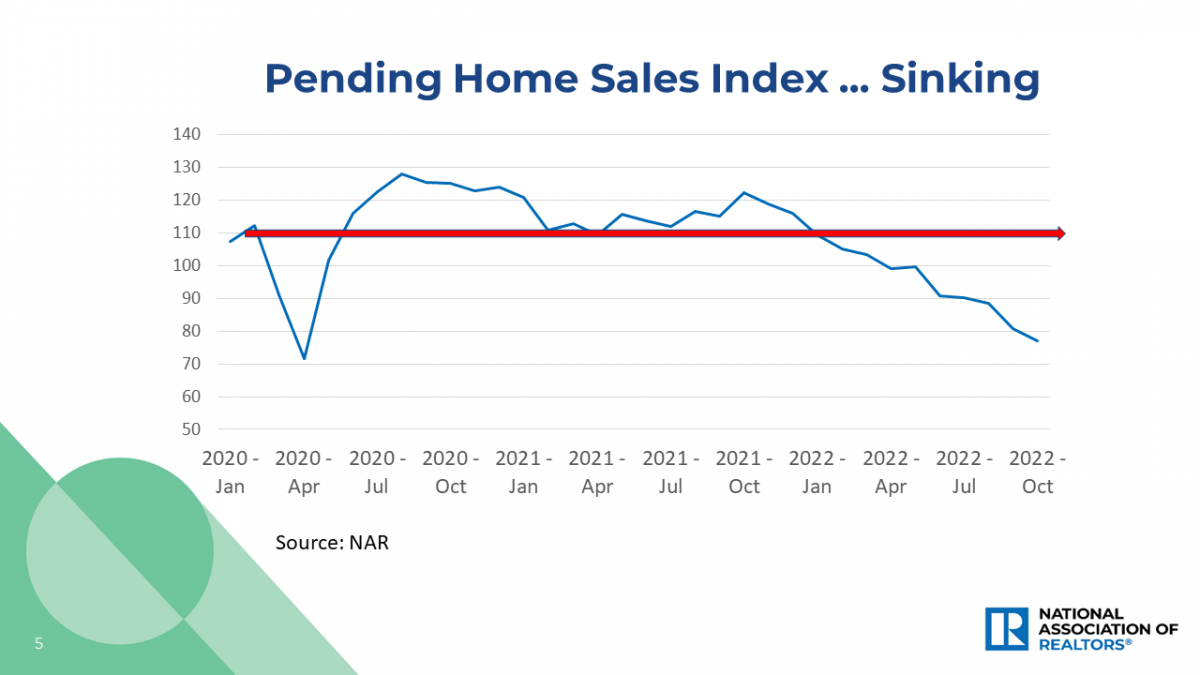

After a troublesome interval in current months for residence gross sales, the falling mortgage charges and internet new job additions ought to assist help housing demand going ahead.