The Nationwide Affiliation of REALTORS® reported that house costs continued to rise within the second quarter of 2023. Nationwide median costs fell 2.4% year-over-year to $402,600. Median house costs rose by 8.5% in comparison with the earlier quarter. There was a complete of 128 metro areas that had year-over-year worth will increase within the second quarter of 2023.

Month-to-month mortgage funds on a single-family house this quarter elevated to $2,051 in comparison with $1,837 from a yr in the past. Qualifying median household revenue rose to $98,429 in comparison with the primary quarter of 2023, which was $89,486 however was $88,200 a yr in the past. The efficient 30-year fastened mortgage fee elevated to six.57% within the second quarter of 2023 in comparison with 5.32% one yr in the past. Median household incomes rose to $91,270 within the second quarter of 2023 in comparison with $87,181 a yr in the past.

Understanding the mortgage charges and the qualifying incomes for down funds will assist potential householders determine which metro areas are reasonably priced for them.

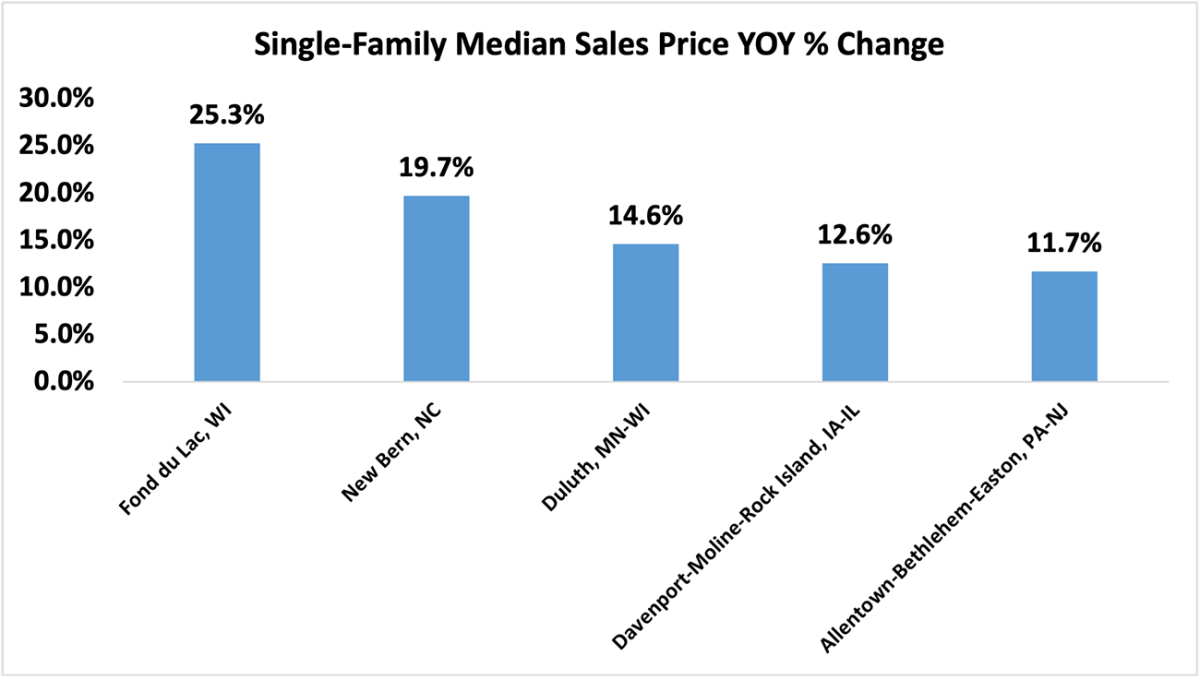

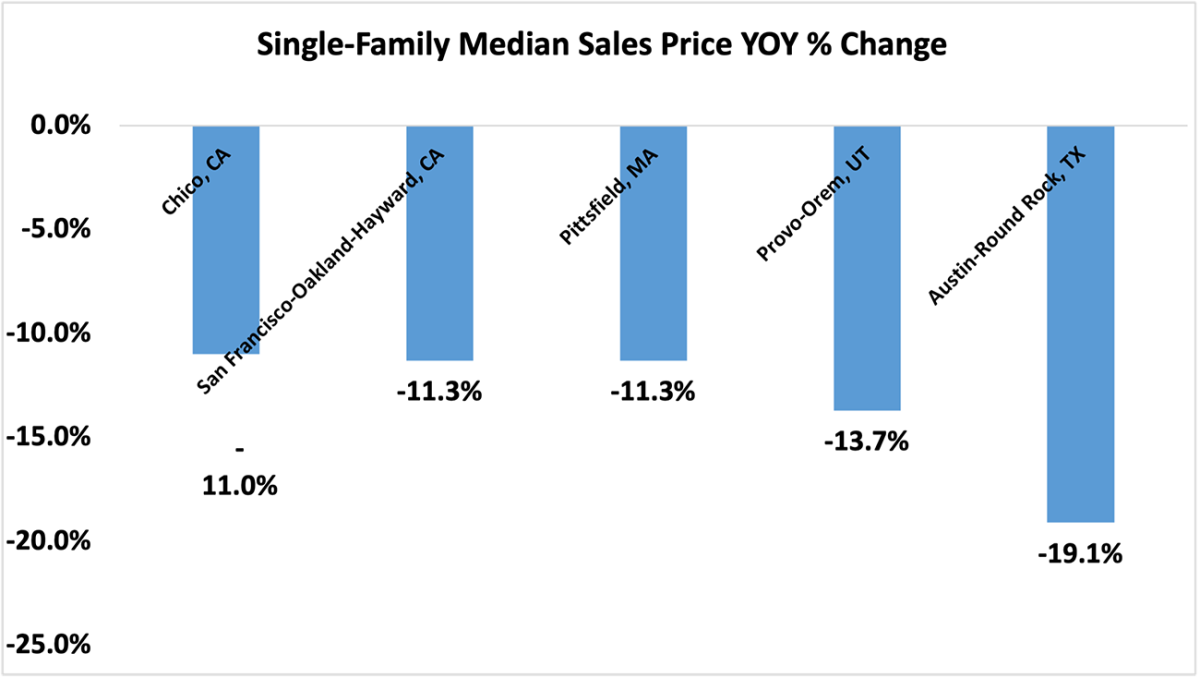

Here’s a take a look at the metro areas with the strongest worth progress within the second quarter of 2023, in addition to a take a look at the yearly change in median present single-family house costs among the many high 5 highest and lowest progress metro areas of the second quarter of 2023.

These are the highest 5 single-family metro areas with the very best house worth appreciation:

These are the underside 5 single-family metro areas with the slowest house worth appreciation:

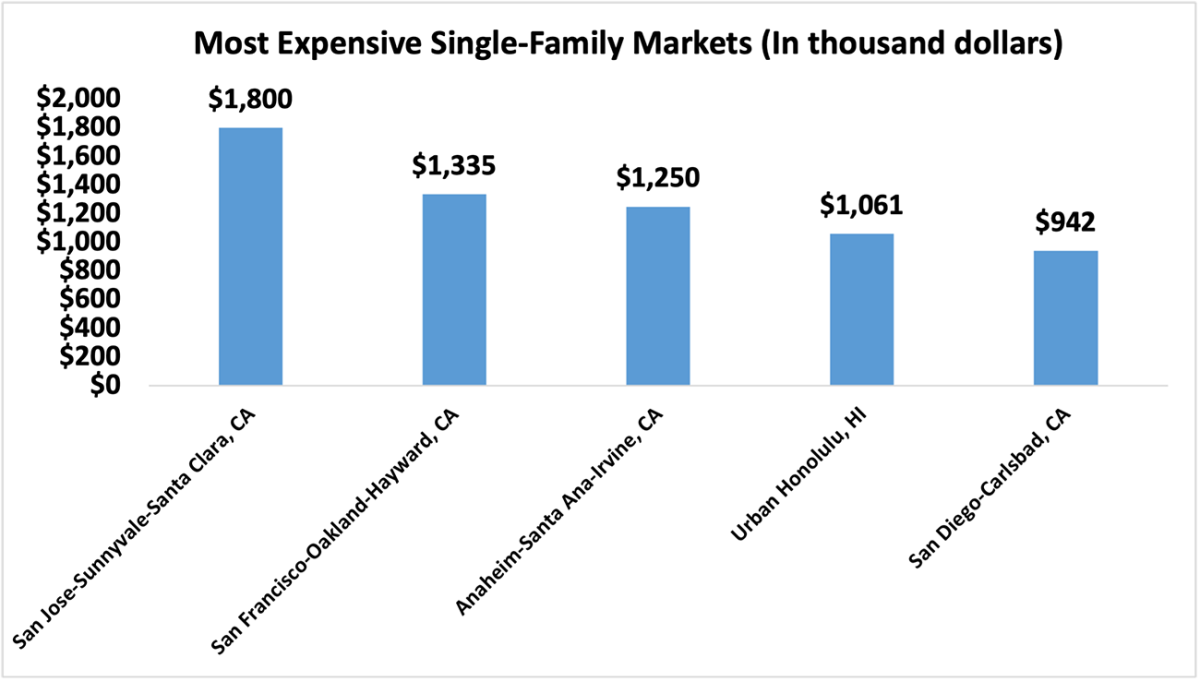

These are the costliest metro areas for the second quarter of 2023:

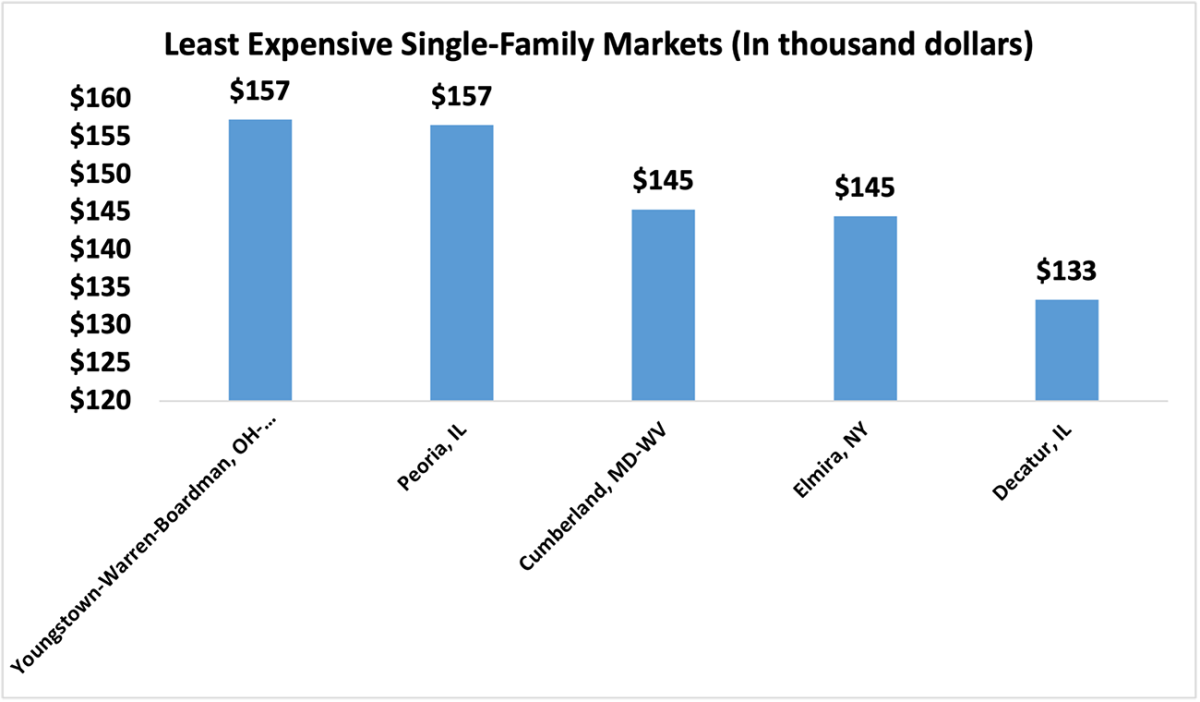

These are the least costly metro areas for the second quarter 2023:

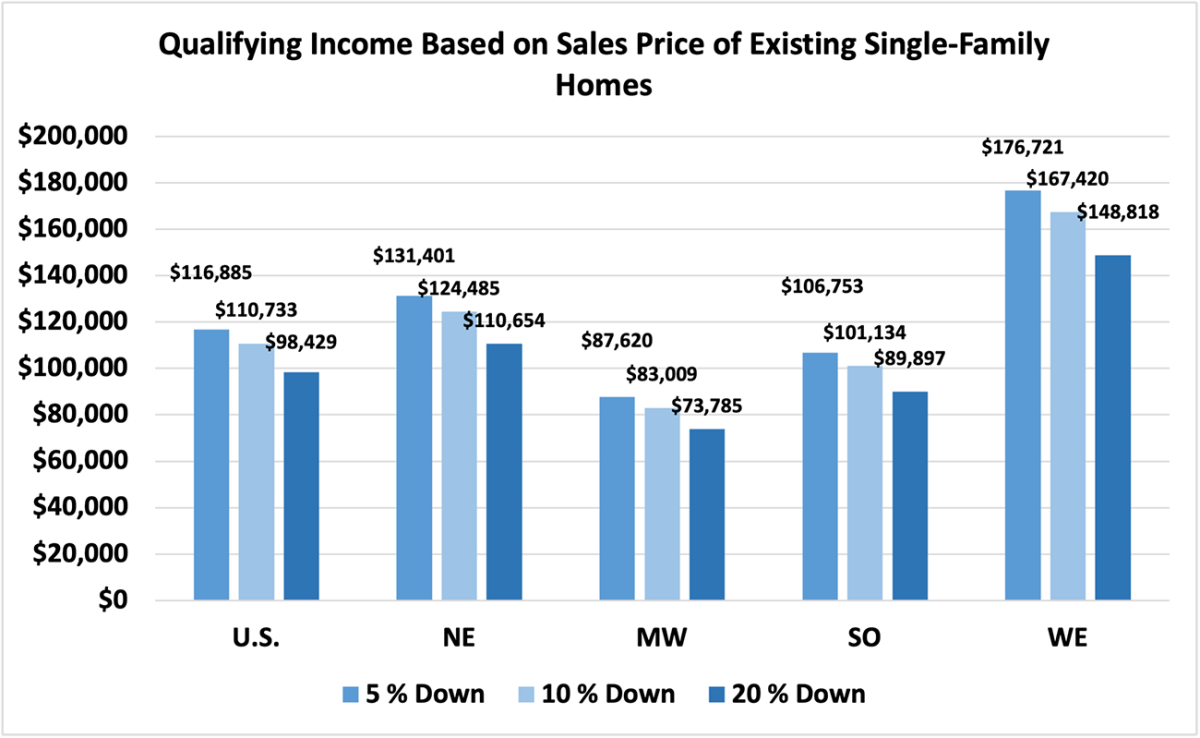

Qualifying Revenue Based mostly on Gross sales Worth of Current Single-family Properties for Metropolitan Areas by Area

For the U.S., on the 5% down-payment threshold, the qualifying revenue quantity for the second quarter of 2023 was $116,885. On the 10% down-payment mark, the qualifying revenue was $110,733, and with a 20% down-payment, the revenue required to qualify for a mortgage was $98,429. The West led all areas with the very best qualifying revenue, whereas the Midwest had the bottom revenue for five%, 10%, and 20% down funds on a single-family house.