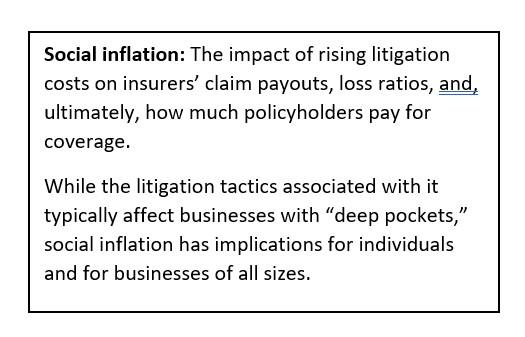

Second publish in a sequence on social inflation and litigation funding

Litigation funding – during which third events assume all or a part of the price of a lawsuit alternate for an agreed-upon proportion of the settlement – is usually cited as contributing to social inflation. However, like a lot else related to social inflation, it’s unclear how widespread the follow is.

With historical roots in Australia and the UK, funding of lawsuits by buyers has taken maintain in the US lately. On the constructive facet, it might let plaintiffs make use of specialists to develop efficient methods – choices as soon as solely out there to giant company defendants.

However it can also contribute to instances making it to court docket based mostly extra on investor expectations than on plaintiffs’ finest pursuits.

Erosion of common-law prohibitions

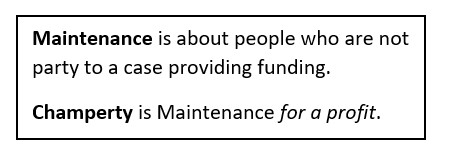

Litigation finance was as soon as broadly prohibited. The related authorized doctrine – referred to as “champerty” or “upkeep” – originated in France and arrived in the US by the use of British widespread legislation. The unique goal of champerty prohibitions – in accordance with an analysis by Steptoe, a global legislation agency – was to stop monetary hypothesis in lawsuits, and it was rooted in a common distrust of litigation and cash lending.

There’s an irony right here, in {that a} main societal drive driving social inflation at this time – mistrust of firms and litigation – as soon as motivated the prohibition of a follow now broadly related to the phenomenon.

These bans have been eroded in current many years, resulting in will increase in litigation funding.

“In case you are attempting to grasp how we bought right here, I’d say begin within the Nineteen Nineties,” says Victoria Shannon Sahani, a professor of legislation on the Arizona State College Sandra Day O’Connor School of Legislation. “The US isn’t actually an enormous participant on the scene but, however you’ve bought Australia and the UK independently making strikes of their legislatures that paved the best way for litigation funding to grow to be extra prevalent.”

Between 1992 and 2006, Sahani says, “It was form of the Wild West of Australian legislation within the sense that if you happen to engaged in litigation funding, you all the time ran the danger that your settlement is likely to be challenged.”

In 2006, the Excessive Court docket of Australia offered readability, saying litigation funding was permitted in jurisdictions that had abolished upkeep and champerty as crimes and torts. It was even acceptable for a funder to affect key case selections.

The follow took time to achieve traction in the US as a result of champerty prohibitions are left to states. Some have deserted their anti-champerty legal guidelines over the previous 20 years. Some, like New York, have adopted “secure harbors” that exempt transactions above a sure greenback quantity from the attain of the champerty legal guidelines.

“Given the stakes contain in lots of instances, it will likely be attention-grabbing to see whether or not litigation funders chorus from direct involvement.”

– David Corum, vp, Insurance coverage Analysis Council

Uncertainty as to market dimension

There isn’t any consensus as to how a lot buyers spend on U.S. lawsuits annually, according to Bloomberg law, “however it’s not $85 billion, a quantity just lately put ahead because the ‘addressable market’ for litigation finance by a publicly traded litigation financier.”

That’s as a result of the trade spent solely about 2.7% of $85 billion throughout a 12-month span that began in mid-2018, in accordance with a Westfleet Advisors survey.

“Does that low penetration fee portend explosive progress forward?” Bloomberg Legislation asks. “Or is it a sign that litigation finance is a distinct segment product most plaintiffs and attorneys discover pointless?”

A key determinant of progress will be the willingness of funders to stay uninvolved in managing instances, mentioned David Corum, vp with the Insurance coverage Analysis Council: “Given the stakes contain in lots of instances, it will likely be attention-grabbing to see whether or not litigation funders chorus from direct involvement.”

Profit, bane, or each?

Whereas funders tout the “David versus Goliath” facet of serving to small plaintiffs in opposition to firms, opponents worry about introducing revenue right into a course of that’s presupposed to goal at a simply final result. A settlement could also be rejected due to stress exerted by profit-seeking funders, and a plaintiff might stroll away with nothing if the trial goes in opposition to them, opponents say.

Laura Lazarczyk, government vp and chief authorized officer for Zurich North America, referred to as litigation funding “abusive” and mentioned hurt “can be largely borne by insurers in protection prices and indemnity funds and by policyholders in uncovered losses and better premiums.”

Critics additionally decry a scarcity of transparency. Whereas the U.S. District Court docket for New Jersey held that third-party funding have to be disclosed, makes an attempt to move federal disclosure laws have been unsuccessful.

“It’s a multibillion trade with no regulation and no necessities for transparency,” mentioned Web page C. Faulk, senior vp of authorized reform initiatives on the U.S. Chamber of Commerce. “It’s primarily turning our U.S. courtrooms into casinos, which is why the chamber is asking for disclosure.”

Such considerations led the American Bar Affiliation final 12 months to approve finest practices for companies partaking in litigation funding. The decision is silent on disclosure, however it urges attorneys to be ready for scrutiny. It additionally cautions them in opposition to giving funders recommendation a few case’s deserves, warning that this might increase considerations about the waiver of attorney-client privilege and expose attorneys to claims that they’ve an obligation to replace this steering because the litigation develops.

Earlier within the sequence

Social inflation: Consuming the elephant within the room

Extra from the Triple-I Weblog

What’s social inflation? What can insurers do about it?

Litigation funding rises as common-law bans are eroded by courts

Attorneys’ group approves finest practices to information litigation funding

Social inflation and COVID-19

IRC examine: Social inflation is actual, and it hurts customers, companies

Florida dropped from 2020 “Judicial Hellholes” record

Florida’s AOB disaster: A social-inflation microcosm