In a current report co-authored with College of Chicago Professor Daniel Hemel, I described how our retirement tax system favors the wealthy disproportionately.

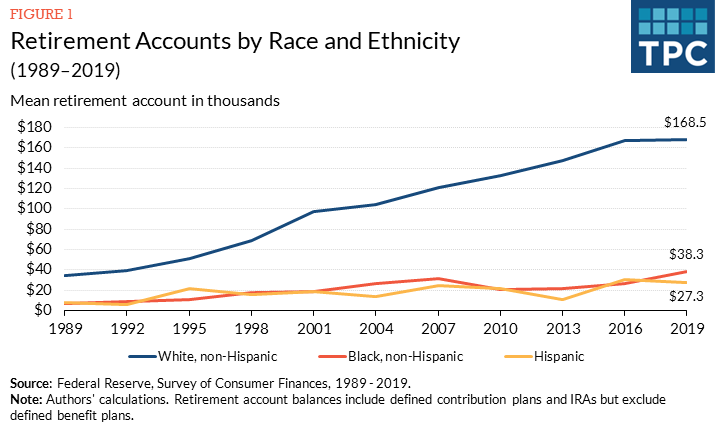

However it’s worse than that: Our system of beneficiant tax subsidies for retirement financial savings—corresponding to 401(ok) plans, different outlined contribution plans, and particular person retirement accounts (IRAs)—additionally exacerbates racial inequities. Due partially to those tax breaks, the hole between the common retirement account balances of White households and Black and Hispanic households widened markedly during the last three a long time.

Retirement accounts by race/ethnicity

In response to the latest Survey of Consumer Finances, White households held, on common, an account steadiness of $168,500 in 2019, whereas the common steadiness of Black and Hispanic households was $38,300 and $27,300, respectively. And whereas 57 % of White households held retirement belongings, solely 35 % of Black households and 26 % of Hispanic households had financial savings in retirement accounts.

These estimates don’t embody conventional employer pension plans (referred to as outlined profit plans) however, nonetheless we slice the info, the image seems largely the identical. The Federal Reserve estimates that the mixed worth of outlined profit plans, outlined contribution plans, and insurance coverage annuities totaled nearly $30 trillion, one of many largest components of household wealth within the first quarter of 2021. (The Fed’s estimates of pension entitlements exclude IRAs.)

Pension entitlement by race/ethnicity

White non-Hispanic households held 79 % of pension wealth, whereas 9 % was held by Black non-Hispanic households, 4 % by Hispanic households, and eight % by different racial or ethnic teams (together with individuals who establish as multi-race). Against this, in 2019 about 65 % of households have been White non-Hispanic, 14 % have been Black non-Hispanic, 10 % have been Hispanic, and 11 % have been in different racial or ethnic teams.

How did retirement financial savings develop so massive? Over the past three a long time, Congress, largely by way of bipartisan tax changes, ratcheted advantages up. In the present day, retirement tax advantages are the most important income tax expenditure on the books, costing tons of of billions of {dollars} a 12 months.

Retirement expenditures

Not solely has Congress’ largesse stripped income from authorities coffers, but it surely additionally overwhelmingly benefited high-income savers, these more than likely to have the discretionary earnings to place apart in tax-favored accounts. These high-income households are overwhelmingly White.

Congress now’s poised to extend its streak of poor retirement tax policy by creating much more beneficiant tax advantages that might largely profit high-income households. Congressional Democrats additionally plan to sort out one high-profile downside, mega-IRAs. However mega-IRAs are merely a symptom of a extra critical illness: our damaged retirement tax system. Addressing that can require a major reorientation in retirement policy, not token options that ignore the true downside.