Growing Function of iBuyers in Money Affords

The rise of particular person house purchasers making all-cash affords has been pushed by intense competitors from instantaneous patrons (iBuyers) who make instantaneous money affords like OpenDoor, Redfin Now, Zillow Offers, Keller Offers and lots of different corporations or front-facing web sites that supply to shortly buy the properties for money (SellHouseCash.com, FastHomeOffer.com, SameDayHomeSale.com, BAMHomeBuyers.com, ExpressOffers.com, AmericanFastHomeBuyers.com).

Nonetheless, new fashions are creating the place the institutional patrons will not be shopping for the property for his or her account however buying the property for the client or offering money for the client to make a proposal. The target is to extend the competitiveness of the client’s provide by enabling the client to supply money or assuring the vendor that if the client cannot discover mortgage financing, the institutional patrons will purchase the house for money.

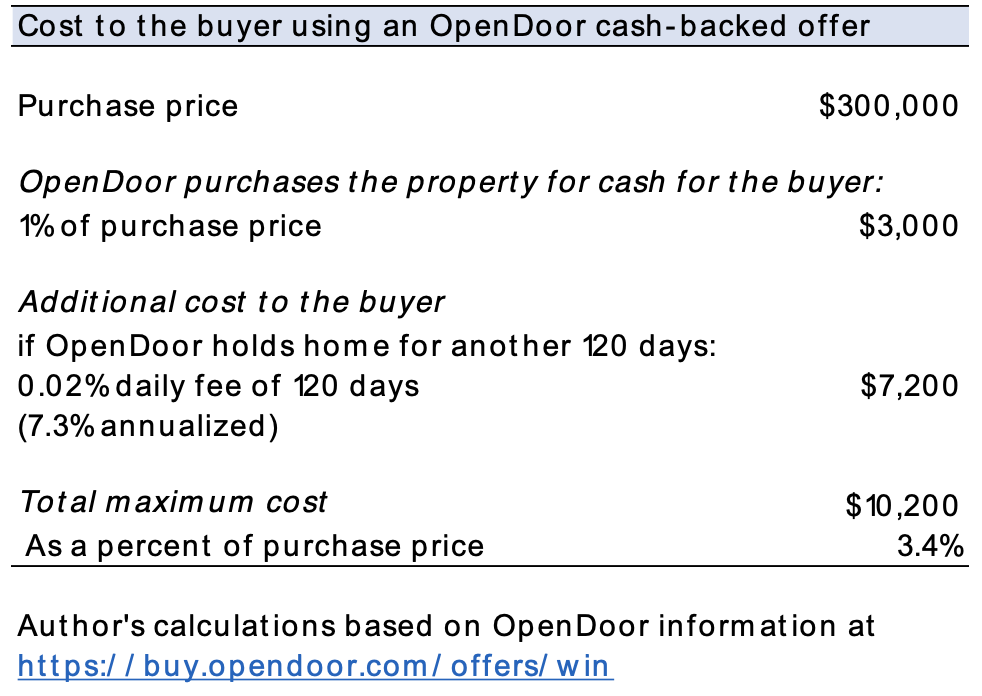

OpenDoor launched its cash-backed provide program3 on March 4, 2021, whereby it backs up the client’s provide with a money provide to the house vendor if the client fails to safe financing by the deadline. Basically, the OpenDoor cash-backed provide supplies the client extra time to acquire mortgage financing whereas closing on a house and in addition offers assurance to the vendor of a house that the sale will shut. If the client is just not in a position to safe financing, then OpenDoor purchases the house for the client and holds the house for 120 days without charge to the client with a price of 1% of the acquisition value. If the client is just not in a position to safe financing and needs to carry the house for an additional 120 days, the client pays OpenDoor 0.02% per day of the acquisition value. Within the desk under, I calculated the fee for the client. Assuming that OpenDoor purchases the home for the client and the client wants an extra 120 days to safe financing, the entire value on a $300,000 is $10,200, or 3.4% of the acquisition value.

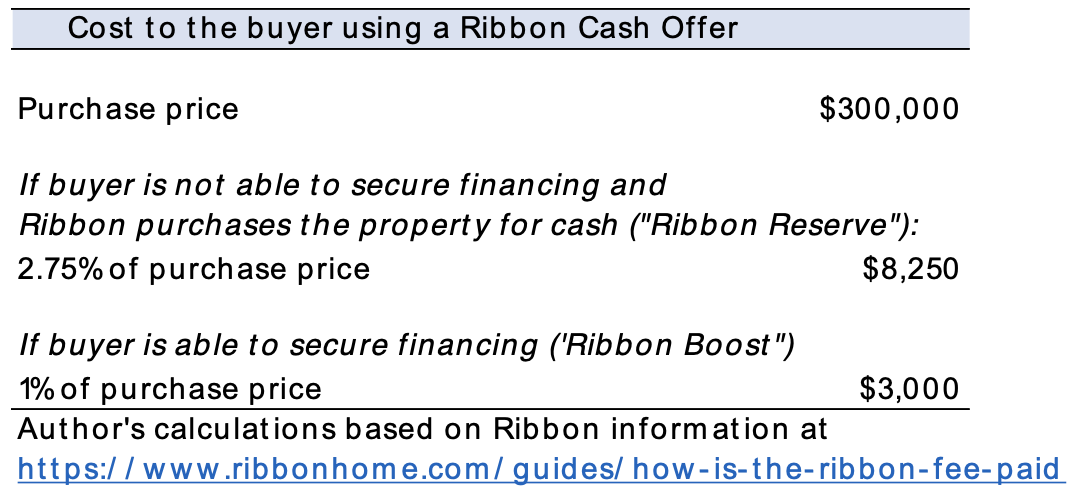

Ribbon purchases the house from the vendor for money on the client’s behalf if the client is just not in a position to safe mortgage financing. Just like OpenDoor, the Ribbon Provide supplies the client extra time to acquire mortgage financing whereas closing on a house and in addition offers assurance to the vendor that the sale will shut. Ribbon’s price is written into the acquisition contract and ranges from 2.0% in North Carolina, South Carolina, and Texas to 2.4% in Georgia and Tennessee, and as much as 2.75% in Florida. Ribbon holds the property for as much as 180 days and if the client is ready to safe financing, the client repurchases from Ribbon on the similar value. Nonetheless, if the client is ready to finance an all-cash buy and doesn’t want Ribbon to buy the property for money, the Ribbon price is 1% of the acquisition value (however the full price should be deposited initially, and the client then simply will get a credit score that goes in the direction of the client’s closing value).

Accept.inc is a lender, and its enterprise mannequin is to prequalify patrons for a money mortgage to make a money provide. Approval can occur as shortly as in 72 hours. As soon as the lender is accepted, the lender can submit an all-cash provide with Settle for.inc’s proof-of-funds. As soon as the all-cash provide wins, the house is bought from the vendor utilizing Settle for.inc’s money. As soon as the client closes on a mortgage, the house is then offered again to the client at precisely the identical value that it was bought for, with no extra prices or markups. So primarily, Settle for.inc is offering an all-cash bridge financing for the client to allow them to shut on a house competitively.

There are not any charges to have a money approval, however it’s most certainly that those that get a money approval have sturdy credit score. The Settle for.inc web site notes that there could be a number of rounds of documentation required, particularly amongst patrons with extra advanced monetary positions, corresponding to those that are self-employed, who ought to count on to be requested to submit a extra in depth checklist of paperwork. Presently, Settle for.inc solely operates in Colorado.

Is the Price of Acquiring a Money-backed Provide Price It?

Based mostly on the calculations above, the price of acquiring a cash-backed provide or money affords is just not a lot increased than the three.7% to 4.4% common p.c above the checklist value that patrons have already been providing to sweeten their provide, in accordance with figures derived from NAR’s month-to-month REALTORS® Confidence Index Survey. Furthermore, cash-backed or money affords give assurance to the vendor that there’s a prepared institutional purchaser who will buy the house ought to the client not be capable to safe mortgage financing.

Money-backed Affords from iBuyers/Fiin-tech Corporations Prone to Develop Attributable to Tight Provide; Will Faucet into First-time Purchaser Market

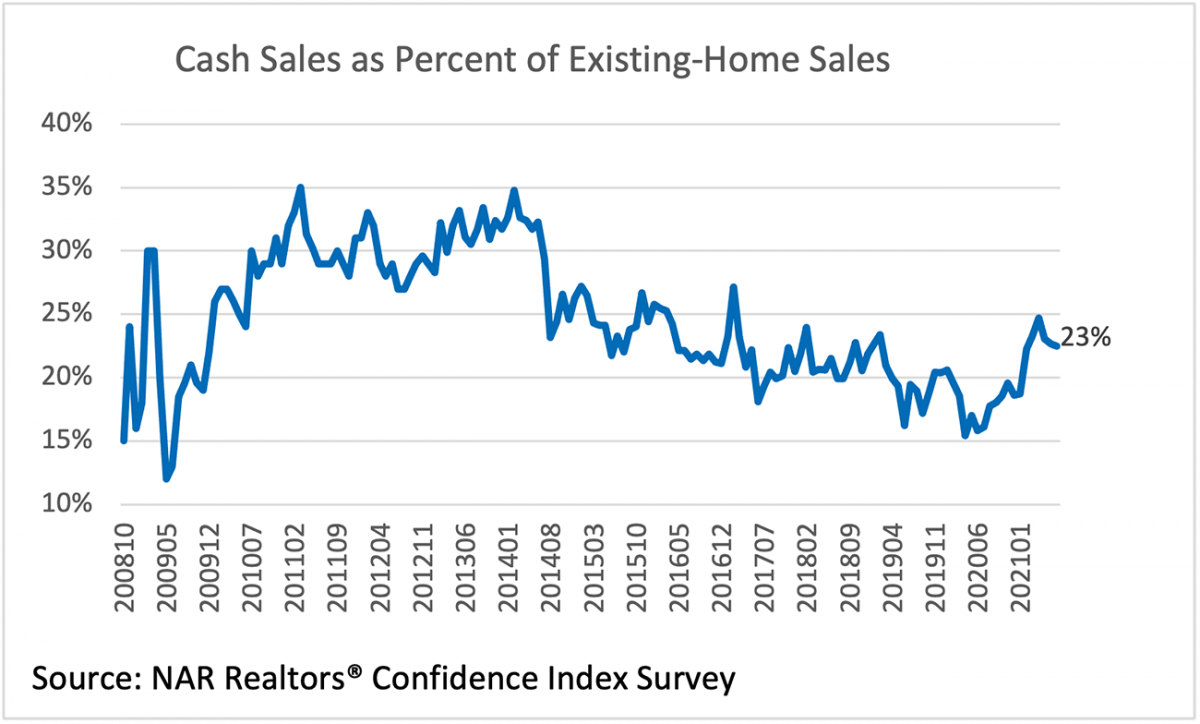

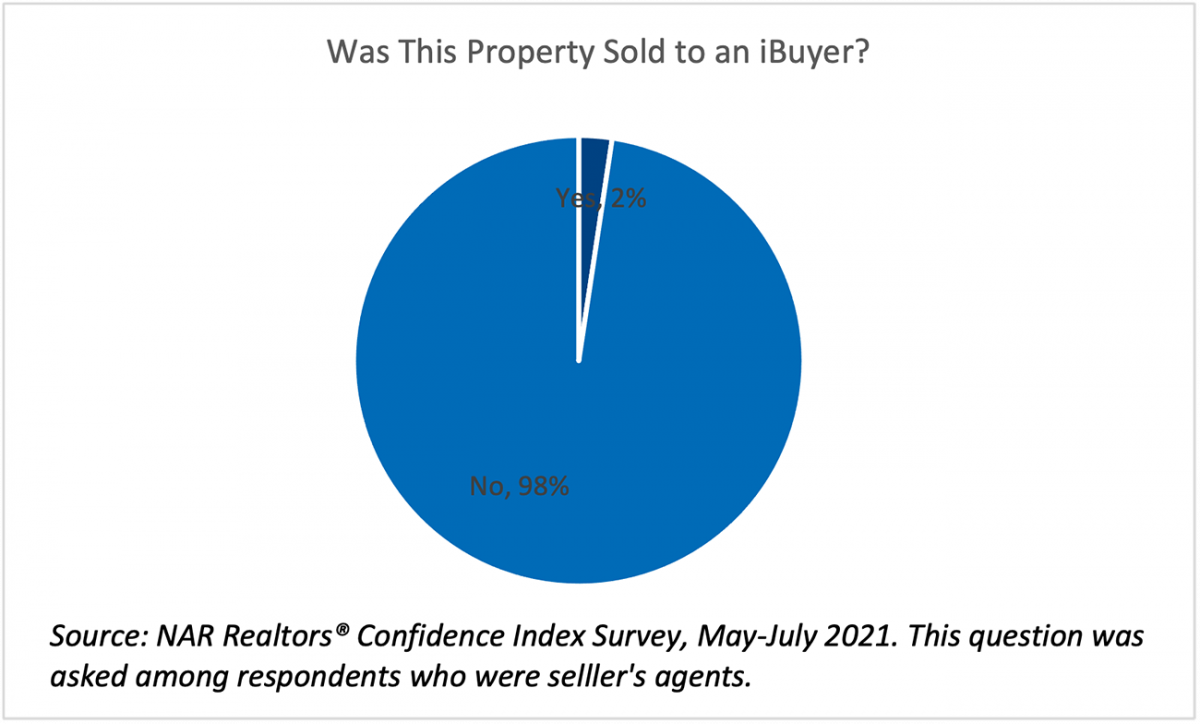

Presently, for these Realtors® who’ve had iBuyers for the properties they offered, 2% of their transactions are to a lot of these patrons.

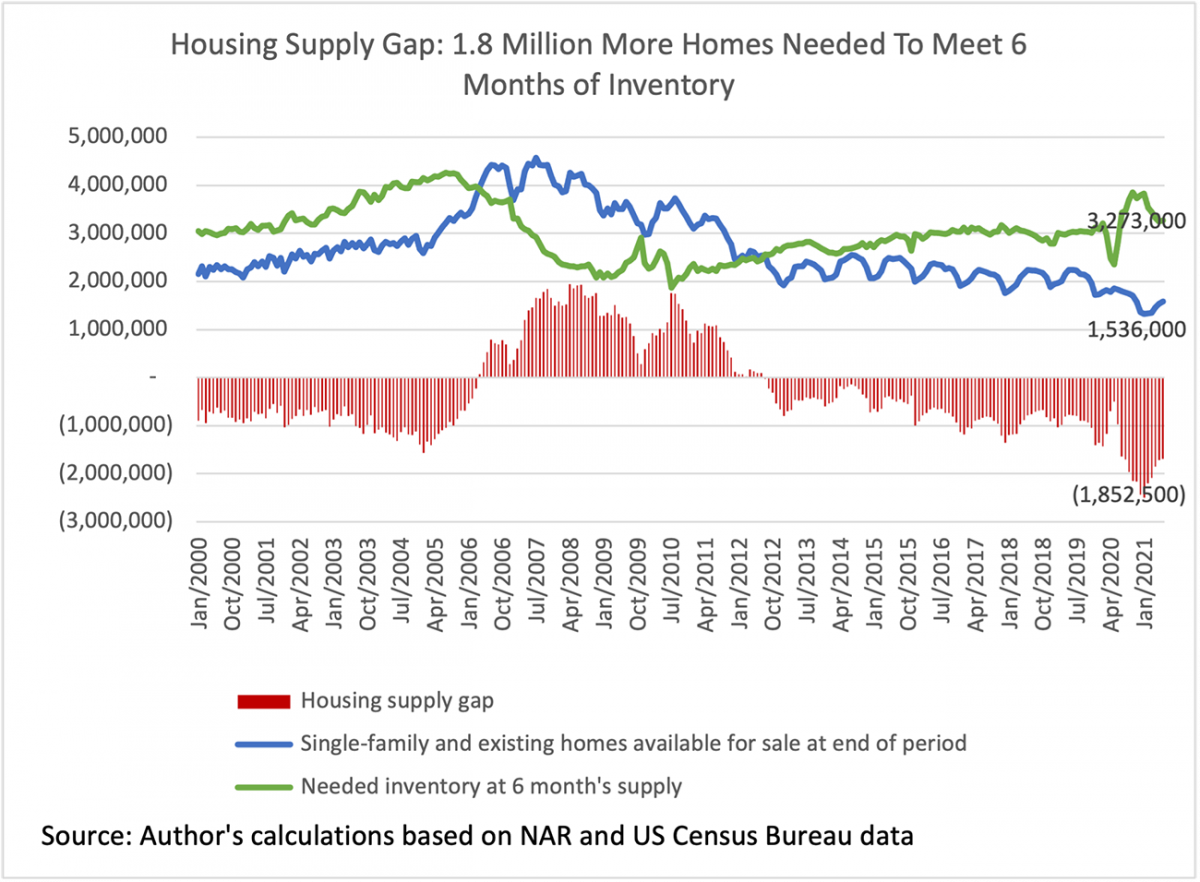

The function of fin-tech corporations or iBuyers in offering cash-backed purchaser affords or money financing will probably solely enhance sooner or later to fill the necessity for patrons to change into aggressive in a market that’s probably going to face a restricted provide of properties for no less than the subsequent 10 years. There’s a hole of 6.8 million underbuilt properties over the previous 20 years, in accordance with NAR/Rosen Consulting Group research. I additionally estimate that the housing provide hole as of June 2021 is at 1.85 million, which is the distinction between the variety of single-family and present properties accessible on the finish of the interval on the market (1.536 million) and the provision wanted on the present tempo of demand that’s equal to 6 months of provide (3.275 million).

First-time patrons have been edged out of the market in a extremely aggressive setting. As of July 2020, the share of first-time patrons fell to 30% from 34% one 12 months in the past. Institutional patrons or fin-tech corporations can enhance the enjoying discipline for patrons who’ve wonderful revenue and credit score profiles (that iBuyers and fin-tech corporations will probably goal) however who lose out to non-first-time patrons who’ve the money to do an all-cash provide. As proven within the knowledge visualization under, homebuyers who bought a house 10 years in the past in present high-cost markets like San Francisco, San Jose, Los Angeles, San Diego, and Seattle have constructed up fairness of over $400,000 that might be used to buy cheaper properties in different markets.

1 iBuyers are corporations that use know-how to make a proposal on a house immediately primarily based on automated valuation of the property. See https://www.opendoor.com/w/guides/what-is-an-ibuyer

2 Fin-tech corporations are corporations that leverage the facility of know-how and knowledge to supply monetary providers to shoppers and companies. See https://www.thestreet.com/technology/what-is-fintech-14885154

3 OpenDoor, https://www.opendoor.com/w/blog/opendoor-introduces-cash-backed-offers