To rejoice Galentine’s Day this 12 months, we’ll take a web page from Leslie Knope’s ebook from Parks and Recreation and rejoice single ladies shopping for properties. These ladies surpass all odds within the housing market and buy properties with decrease family incomes in an more and more unaffordable housing market. Let’s take a look at how they stack up in comparison with their single male counterparts.

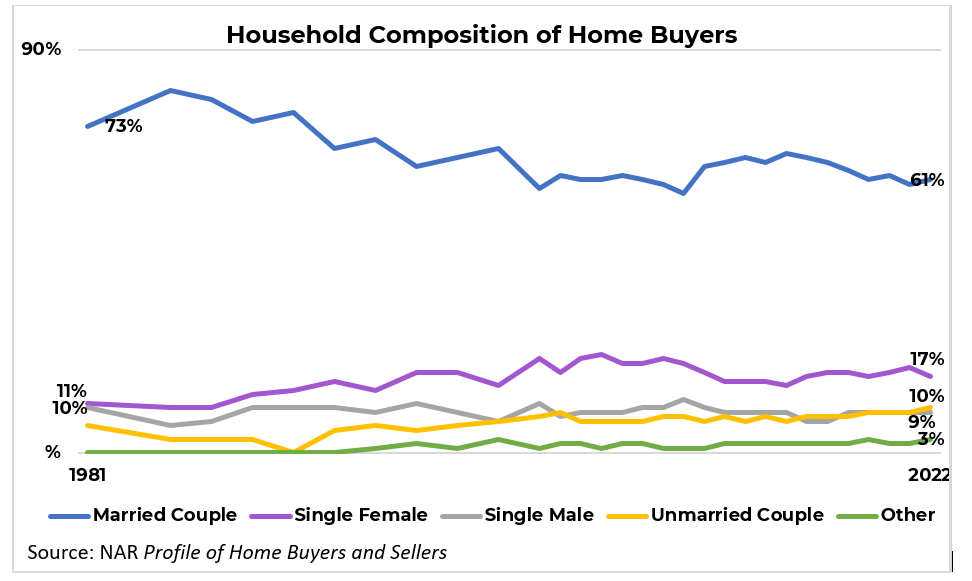

Girls have been second solely to married {couples} within the home-buying market since NAR began information assortment in 1981. This statistic is placing as a result of it wasn’t till 1974 that girls had been legally prohibited from acquiring a mortgage with no co-signer. Earlier than the passage of the Truthful Housing Act’s prohibitions in opposition to “intercourse” discrimination in housing-related transactions, and the protections of the Equal Credit score Alternative Act, it was commonplace for a widow to want a male family member as a co-signer. Below federal legislation, ladies had no authorized recourse for this or every other lending discrimination.

In 1981, 73% of dwelling patrons had been married {couples}, 11% had been single ladies, and 10% had been single males. Immediately these shares stand at 61% married {couples}, 17% single ladies, and 9% single males. The best share of single ladies patrons was in 2006, when the share stood at 22%. Between 2016 and 2022, the share of single ladies has been between 17% to 19%. In 2010, the share of single males rose to a excessive of 12% however has stayed between 7% to 9% of patrons in recent times.

Lately, a simple rationalization for the rise in single ladies patrons was the drop within the share of People who’re married. Utilizing Census data, in 1950, 23% of People ages 15 and up had by no means been married. In 2022, that share stood at 34% of People. That interprets into 37.9 million one-person households within the US at this time—29% of all households.

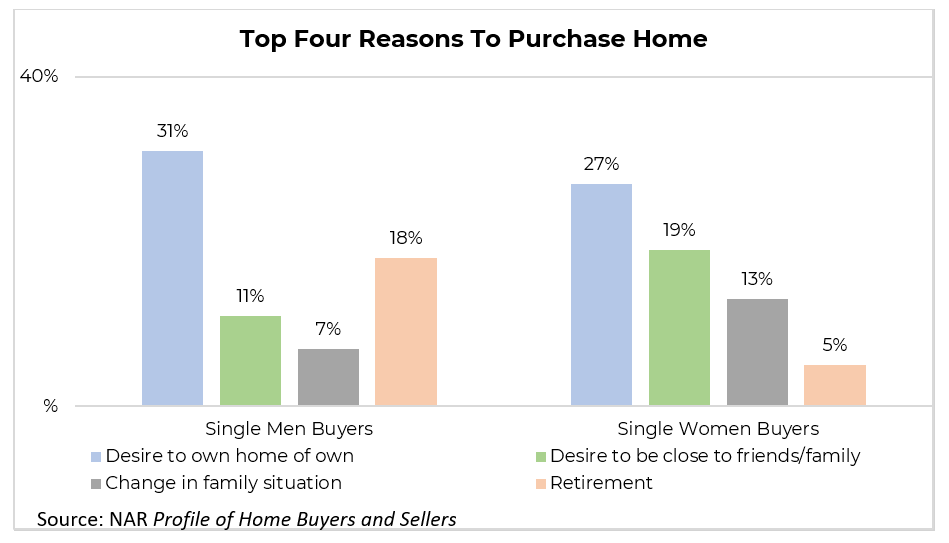

However then, why are ladies shopping for properties and males are usually not? For the attainable reply to that, it’s best to show to who’s shopping for and their family composition. Each women and men are most definitely to say they’re buying for the will to personal a house, however considerably extra ladies buy to be near family and friends. Girls are additionally extra prone to report shopping for due to a change in a household state of affairs, akin to a divorce, loss of life, or beginning of a kid. When gathering on whether or not or not a purchaser is single now, a knowledge level not collected is that if the customer was as soon as married and is now widowed or divorced, however in each eventualities, the proximity to family and friends could also be necessary to ladies.

Single ladies historically prioritize the place their family and friends are in deciding the place to purchase a house. For 41 p.c of girls, their neighborhood alternative is set by the proximity to family and friends, in comparison with 35 p.c of single males. Curiously, males usually tend to cite retirement as a cause to buy 18% in comparison with ladies at simply 5%.

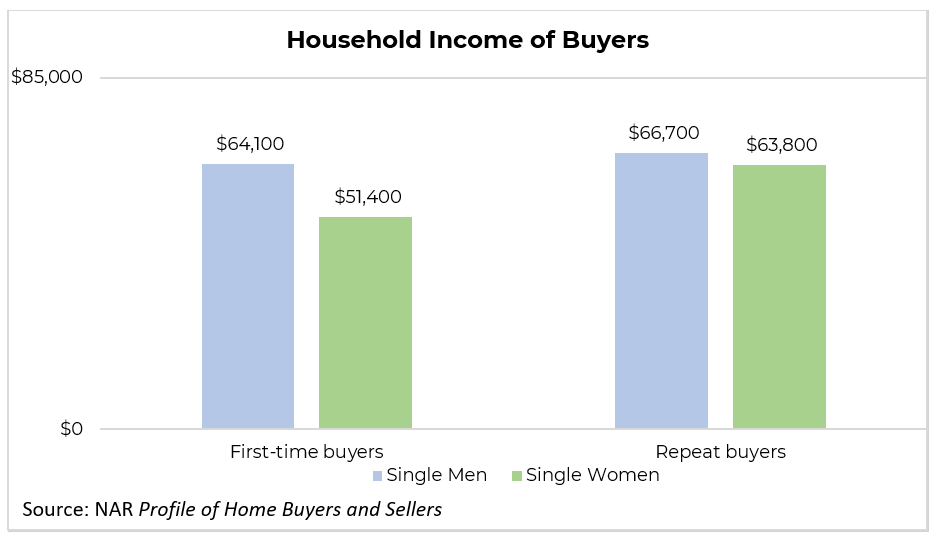

The second central query posed is funds. Girls dwelling patrons sometimes buy a house as first-time patrons at a family revenue of $51,400 in comparison with single males at $64,100. Whereas male incomes don’t match that of married or single {couples}, their increased incomes permit them extra shopping for energy than single ladies patrons. That is particularly necessary when pondering of the current mortgage rate of interest will increase and the rise in dwelling costs. This can be one cause why the age of a single girl first-time purchaser is a median of 38 whereas males have a median age of 37 as first-time patrons.

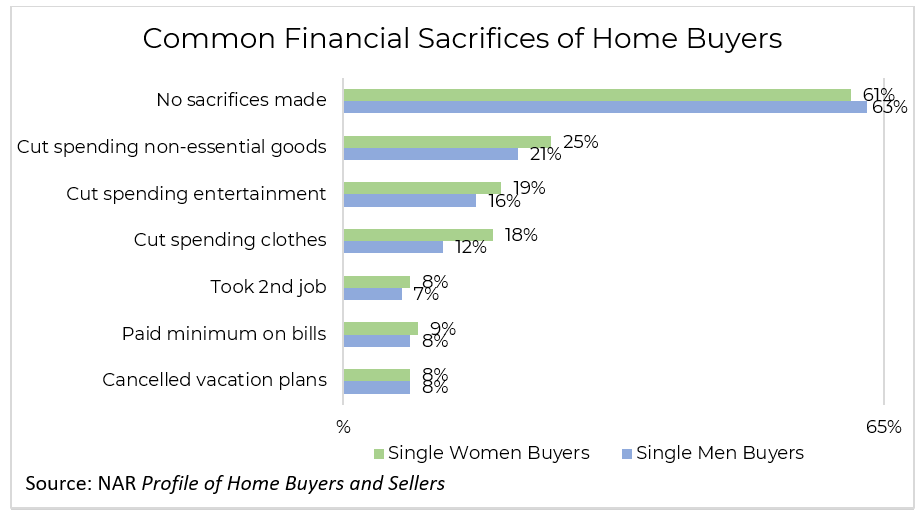

Given decrease family incomes, ladies do make extra monetary sacrifices when buying. Thirty-nine p.c of girls make monetary sacrifices in comparison with 37% of males who buy properties. Frequent monetary sacrifices embody slicing spending on non-essential items, leisure, garments, and even taking up a second job. These sacrifices solely underscore how necessary homeownership is to ladies as these sacrifices all outpace these of male patrons. As famous in a earlier weblog, ladies usually tend to transfer in with associates or household earlier than buying to keep away from paying lease. These sacrifices might add up over a number of years, contributing to the marginally increased age.

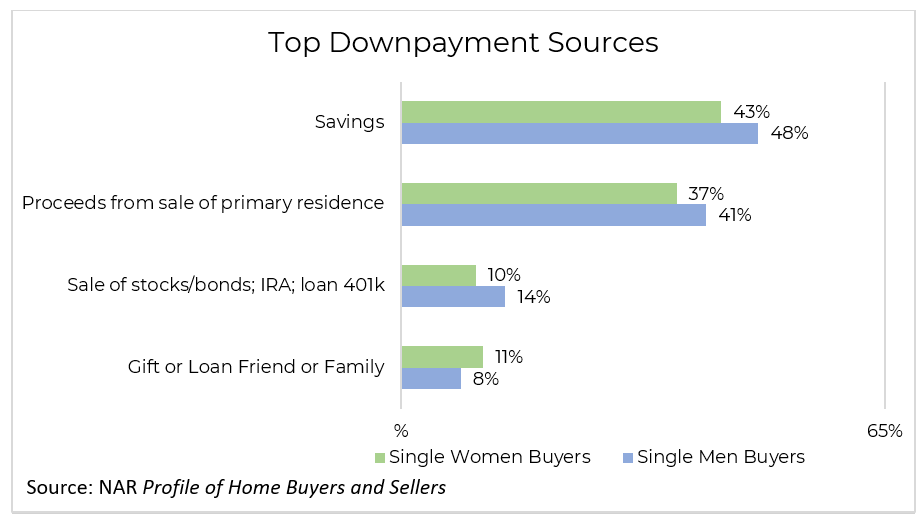

One notable distinction is the supply of the downpayment. Whereas financial savings and gross sales from the final dwelling are the most typical sources for single women and men, there are two notable variations in different sources. Males usually tend to promote inventory or bonds, use their IRA, or take a mortgage from their 401k/retirement at 14% in comparison with ladies at 10%. On the similar time, 11% of single ladies use a present from a pal or relative for his or her downpayment in comparison with 8% of single males.

No matter how these single ladies enter homeownership, they’re discovering a method and doing so at a big tempo. They’re to be celebrated. To them and to all patrons on the market, a contented Galentine’s Day!

For extra on these developments and others, take a look at the total Profile of Dwelling Consumers and Sellers report.