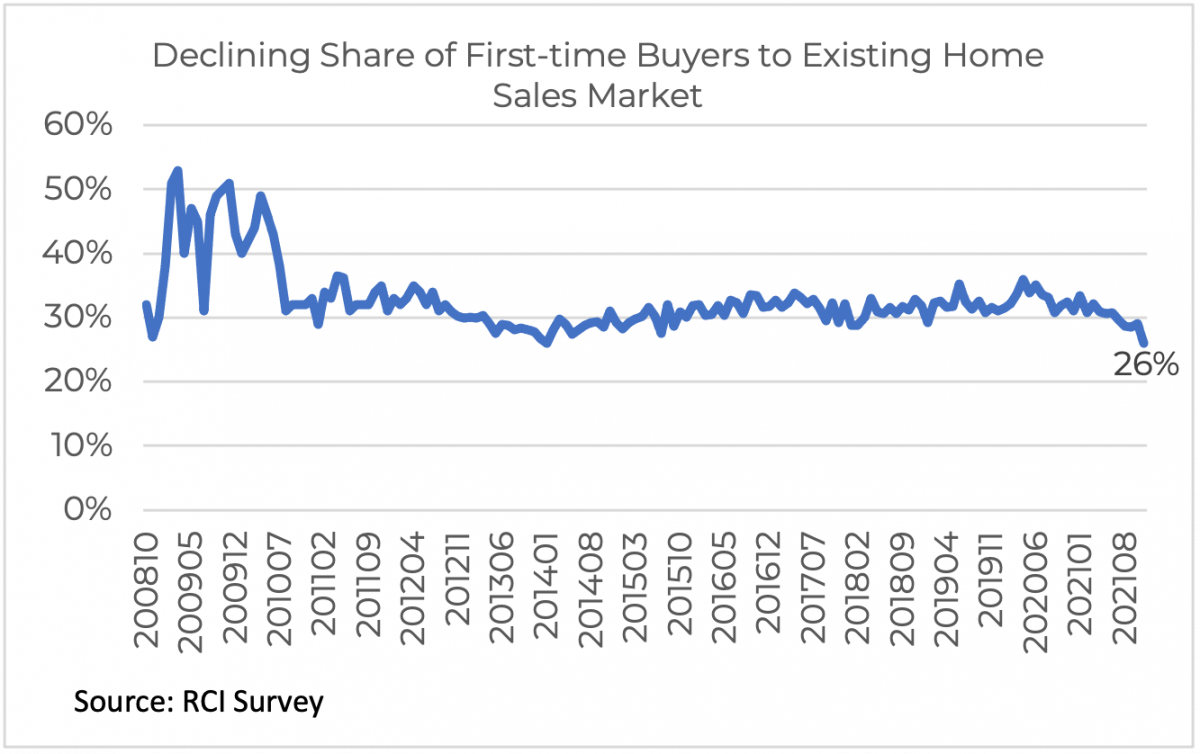

Many first-time patrons proceed to wrestle to maneuver into homeownership amid sustained worth progress and competitors from all-cash patrons. The share of first-time patrons fell to 26% in November, in keeping with the November REALTORS® Confidence Index Survey, a survey of REALTOR® transactions. That is the bottom degree since January 2014 (additionally 26%) and since NAR began monitoring the share of first-time patrons on a month-to-month foundation in October 2008. In 2020, first-time patrons made up 33% of present house sale patrons, in keeping with the RCI Survey. NAR’s 2021 Profile of House Patrons and Sellers additionally reported an annual first-time purchaser share of 34% amongst main residence patrons solely throughout July 2020-June 2021.

There are a number of things that affect the choice of first-time patrons to make a house buy and to achieve success of their provide. Nonetheless, affordability and skill to compete with different patrons are arguably vital elements.

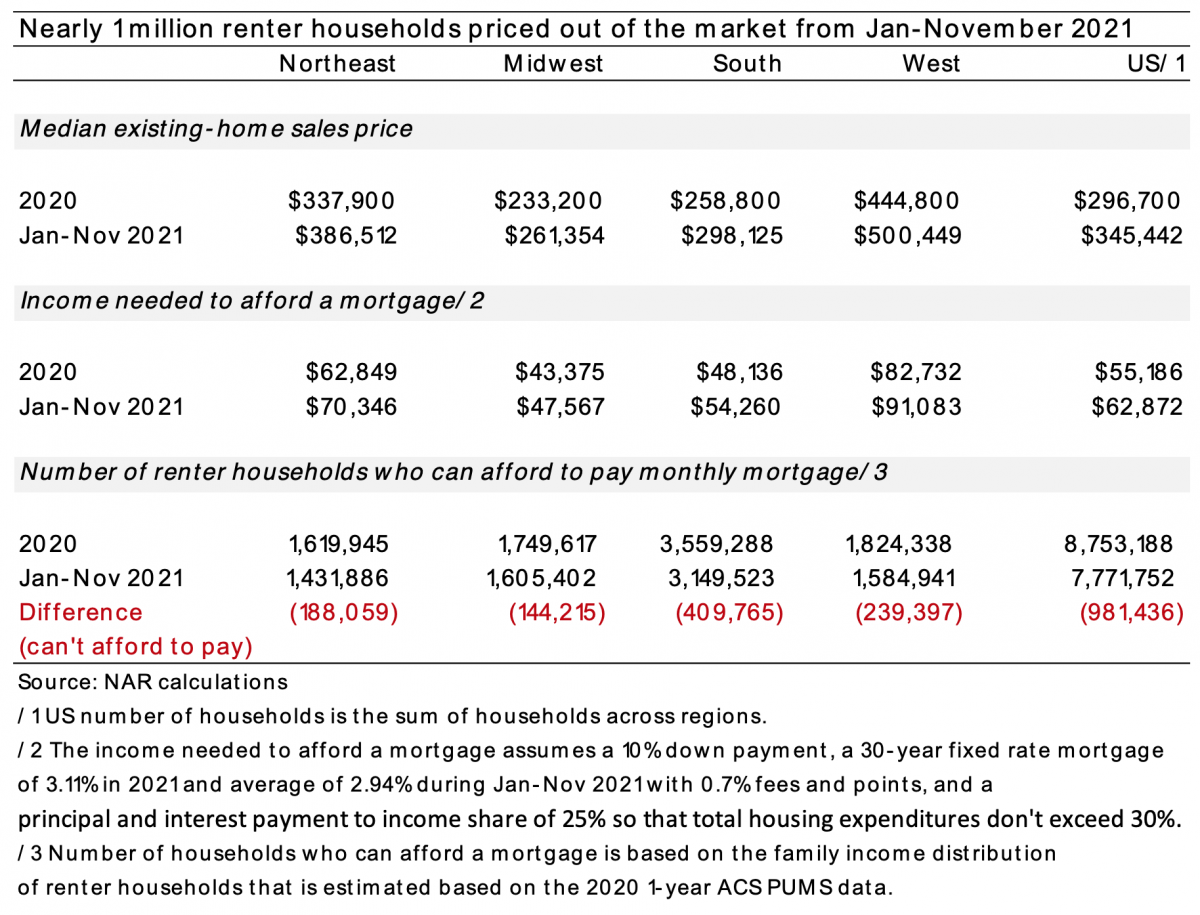

Almost 1 million renter households priced out resulting from rising costs

Below traditionally low mortgage charges and provide bottlenecks, demand has outpaced the provision of properties out there in the marketplace, leading to double-digit worth appreciation. NAR’s newest November present house gross sales information confirmed an uptick within the median present house gross sales worth to $353,900, a 13.9% year-over-year improve.

How the distribution of costs has shifted upwards is indicated by the share of properties priced at as much as $250,000. In 2012, properties priced at $250,000 or beneath made up 68% of the market. As of 2021, that share has been lower in half to simply 30.8%. Properties priced at over $1 million that made up lower than 2% of the market in 2012 now account for six%, or triple the share.

This rise in costs is pricing out potential homebuyers. The desk beneath reveals that almost 1 million renter households bought priced out of the market because of the worth improve in 2021. Throughout January-November 2021, the median existing-home gross sales worth averaged $345,442, a 16.4% year-over-year improve from the median gross sales worth of $296,700 in 2020. At this worth, the revenue a family must pay the mortgage affordably such that the month-to-month mortgage cost and curiosity cost don’t exceed 25% of revenue rose to $62,872, up from $55,186. Primarily based on the revenue distribution of renter households in 2020, I estimated that the variety of renter households who will pay the mortgage affordably declines from 8.75 million to 7.71 million. This implies 980,436 renter households bought priced out of the market, (assuming they’ll make a ten% down cost).

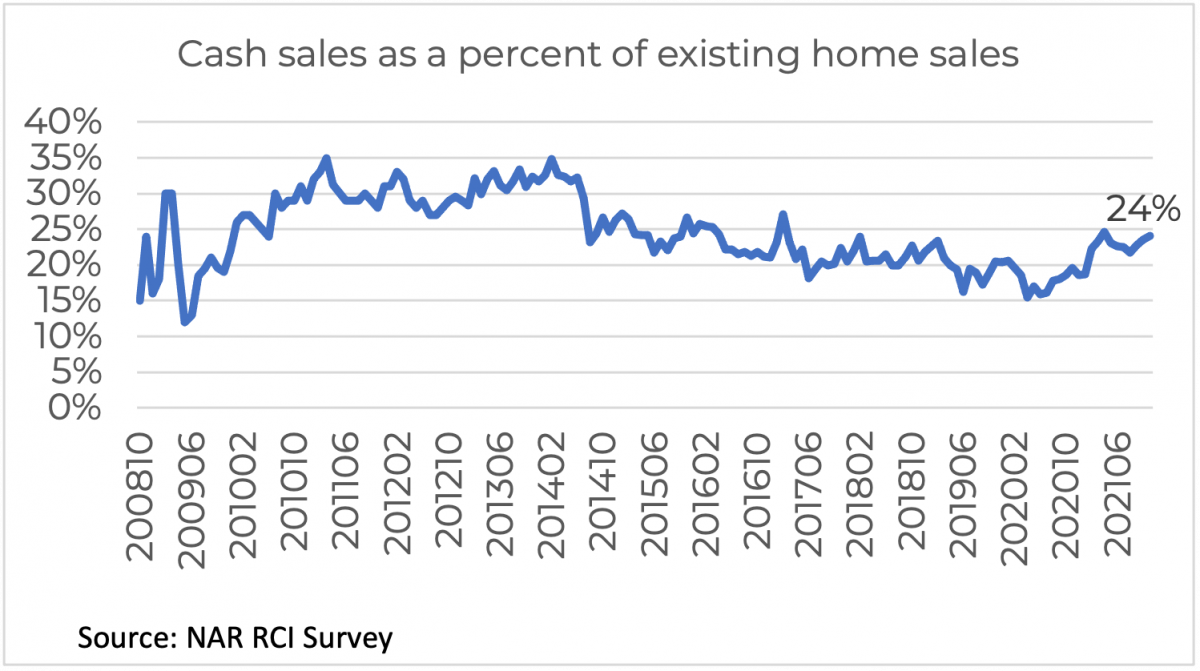

Money Purchaser Share Stays Elevated at 24% However FinTech Firms Are Offering Money Again for Patrons

The share of money patrons of gross sales that closed in November 2021 remained elevated at 24%. Sellers are inclined to favor money patrons as a result of purchaser financing is assured, in contrast to within the case of mortgage financing which has the danger of the contract not closing if the property appraises for a decrease worth and the client can not give you the distinction or the vendor just isn’t keen to deliver down the costs.

First-time patrons are inclined to get hold of a mortgage slightly than make an all-cash buy. Throughout January-November 2021, solely 7% of first-time patrons made an all money buy in comparison with 30% of all non-first-time patrons.

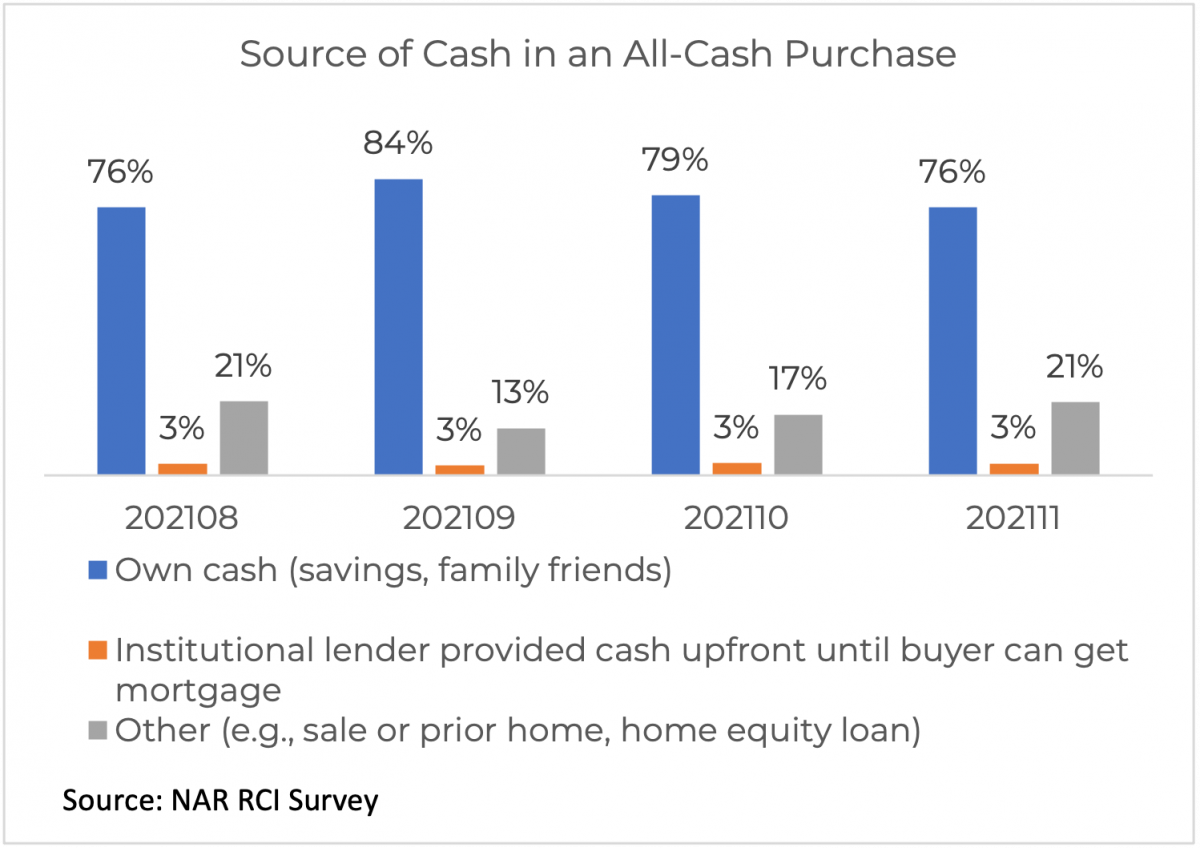

Nonetheless, there are actually fin-tech corporations which have emerged that present the patrons with a cash-back up if they’ll’t get hold of a mortgage on the time of closing or additionally the money if the appraisal worth falls beneath the contract worth. These fin-tech corporations primarily present bridge financing for the client in order that they have financing at closing time, thus decreasing the danger to the vendor that the deal will fall via. In accordance with NAR’s RCI Survey, 3% of the supply of money in an all-cash buy got here from institutional lenders who supplied the money. About three-quarters of all-cash patrons use their financial savings or cash pooled from household/pals and a couple of fifth use money from different sources, primarily the sale of a house or a house fairness mortgage.

For instance, OpenDoor offers the client with money if the purchaser can’t get hold of financing on the time of closing however they don’t cowl the distinction between the appraisal and the contract worth (so the client can waive the financing contingency). OpenDoor costs 0.02% per day beginning after 120 days from the day Open Door supplied the money at closing (annualized price of seven.5%). Ribbon, which operates in a number of states (Georgia, North Carolina, South Carolina, Texas, Tennessee) offers money if the client fails to acquire a mortgage at closing time in addition to the distinction within the appraised worth and the contract worth. It costs a charge of 1% and an extra 2.75% of the house worth if the client can’t shut with their very own financing.

An evaluation of the price to patrons of cash-backed presents reveals that the price of acquiring a cash-backed provide or money presents just isn’t a lot increased than the three.7% to 4.4% common % above the listing worth that patrons have already been providing to sweeten their provide. Furthermore, cash-backed or money presents give assurance to the vendor that there’s a prepared institutional purchaser who will buy the house ought to the client not be capable to safe mortgage financing.

Outlook for First-time Patrons in 2022: Slower Worth Appreciation With Mortgage Fee at Beneath 4%

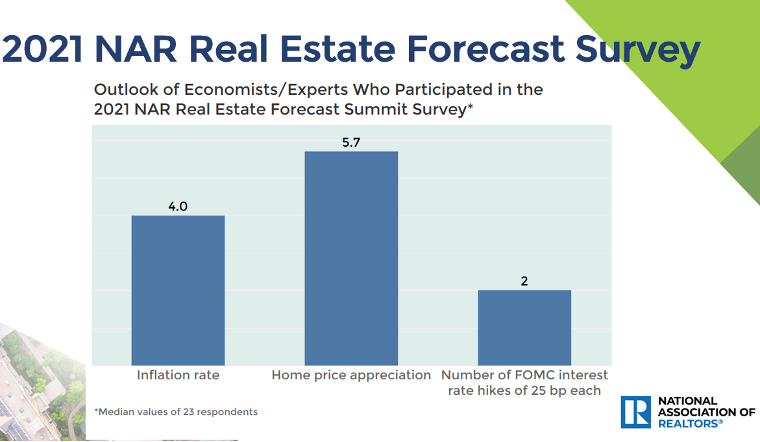

First-time patrons and all patrons will face a much less frenzied market in 2022 with house costs rising extra in step with wage progress. NAR forecasts house costs to extend at lower than 5% in 2022 (2.8% for present house gross sales and 4.4% for brand spanking new house gross sales). A panel of economists, business leaders and coverage makers who participated in NAR’s Actual Property Forecast Summit count on house costs to extend by 5.7% .

Whereas mortgage charges are anticipated to extend because the Federal Reserve reins in inflation again in direction of 2%, the 30-year mounted mortgage price is anticipated to stay low at 3.7% by year-end, a degree that’s beneath the 4% price previous to the pandemic.

Furthermore, mortgage charges are more likely to improve additional in 2022. So homebuyers who’re capable of buy a house in 2022 will be capable to lock in at a decrease mortgage price.