The cutthroat house market has annoyed patrons throughout the nation, with many submitting a number of gives solely to be outbid many times. Low stock, excessive costs and intense competitors are difficult for any purchaser, however first-timer patrons are dealing with the very best hurdles.

Their issues discovering a house are usually not outlined solely by this wild pandemic market. First-time patrons have built-in challenges. Contemplate their monetary image: Typically youthful, they lack a deep credit score historical past, which may imply decrease credit score scores. Their employment historical past is shorter and their earnings is usually decrease than that of older, extra established bidders. First-timers even have had much less time to save lots of for a deposit and an emergency fund. All of this leaves them much less aggressive in bidding wars, much less more likely to safe a mortgage, and fewer interesting to sellers.

The pandemic has magnified these challenges, in response to NerdWallet’s First-Time Home Buyer Metro Affordability Report, which examined the state of the marketplace for this cohort within the 50 largest U.S. cities in the course of the second quarter of 2021.

Throughout that interval, the variety of obtainable listings truly improved from Q1 by 2 p.c in these 50 cities, however fell 5 p.c throughout the nation. In prepandemic years, bigger first- to second-quarter upticks in listings had been the norm. (In 2018 they had been up 10 p.c; in 2019, 6 p.c.) A greater comparability could also be yr over yr: Measured that means, Q2 stock is down 48 p.c from Q2 2020.

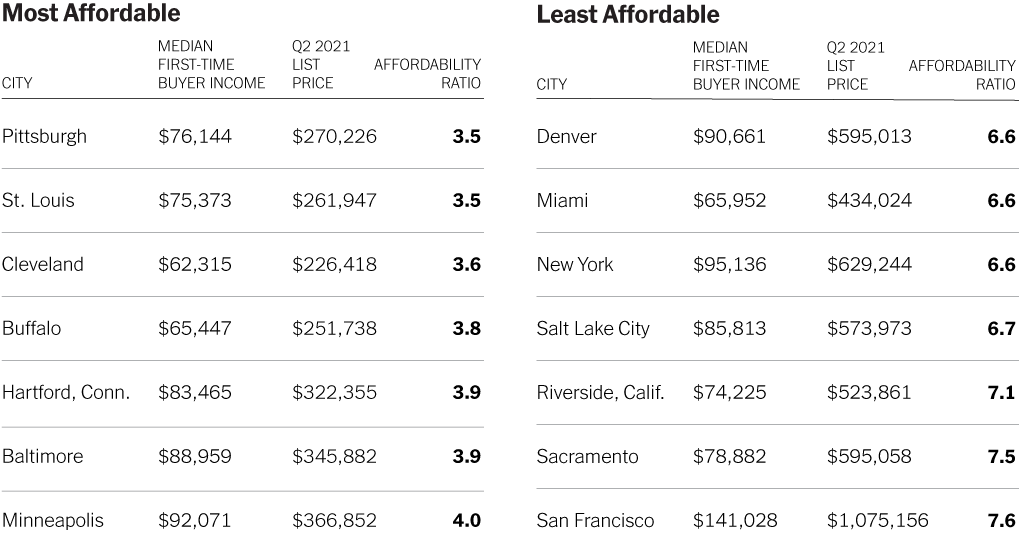

Nevertheless it’s the rising costs (the results of shrinking provide and swelling competitors) which have actually harm first-timers. A common formulation used to find out affordability multiplies earnings by three — so in the event you earn $100,000, you may most likely qualify to purchase a $300,000 house. However within the 50 cities studied, record costs had been, on common, 5.5 instances the native median earnings of first-time patrons, leaving most properties out of attain.

This week’s chart, utilizing knowledge from NerdWallet’s examine, reveals the ten most reasonably priced and 10 least reasonably priced cities for first-timer patrons amongst these 50 cities, ranked through the use of the affordability ratio in every metropolis.