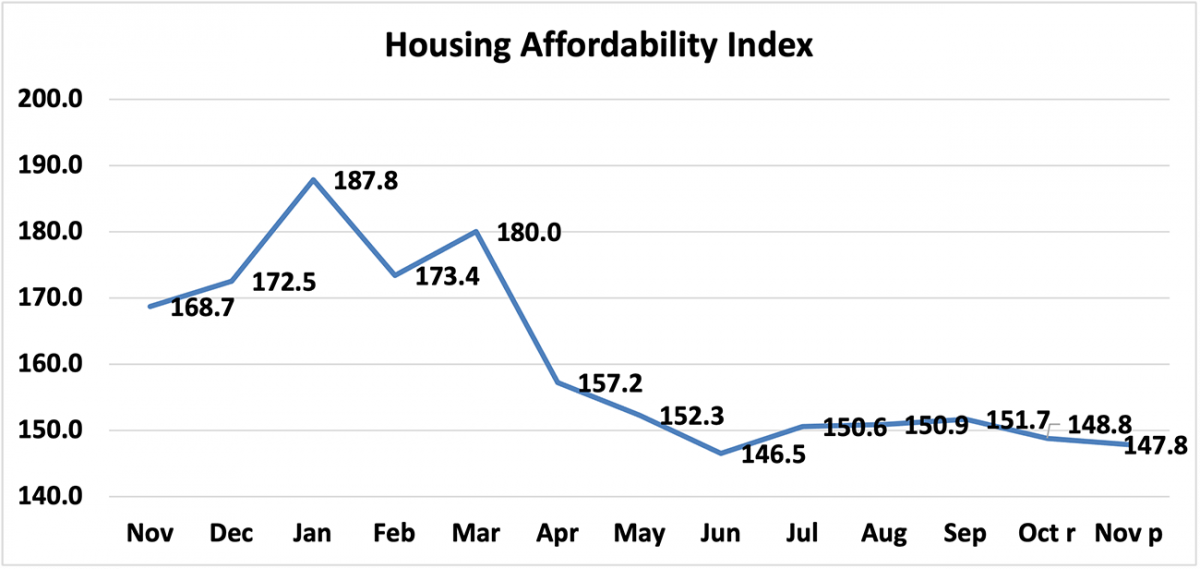

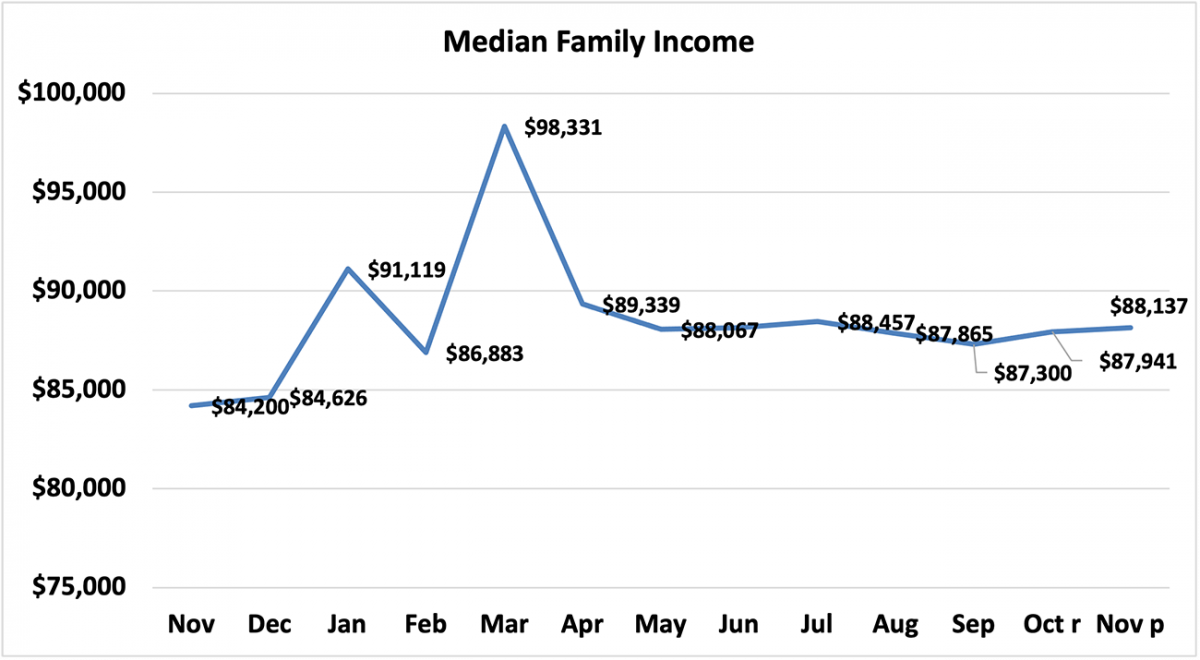

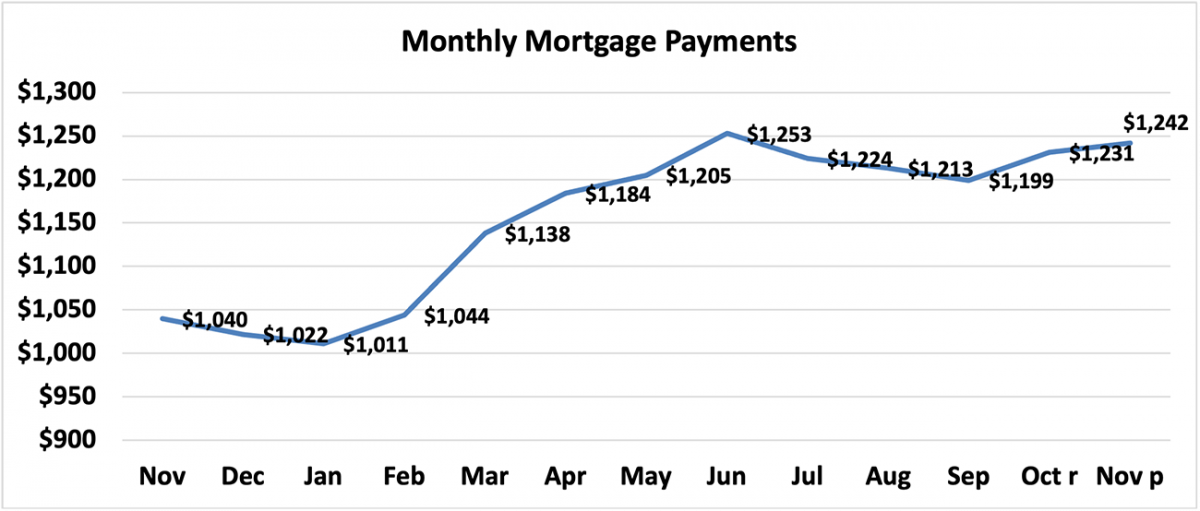

On the nationwide degree, housing affordability barely fell in November in comparison with the earlier month in response to NAR’s Housing Affordability Index. In comparison with the prior month, the month-to-month mortgage cost elevated by 0.9% whereas the median household earnings rose modestly by 0.2%.

In comparison with one yr in the past, affordability declined in November because the median household earnings rose by 4.7% whereas the month-to-month mortgage cost elevated 19.4%. The efficient 30-year mounted mortgage fee1 was 3.12% this November in comparison with 2.82% one yr in the past, and the median existing-home gross sales worth rose 14.9% from one yr in the past.

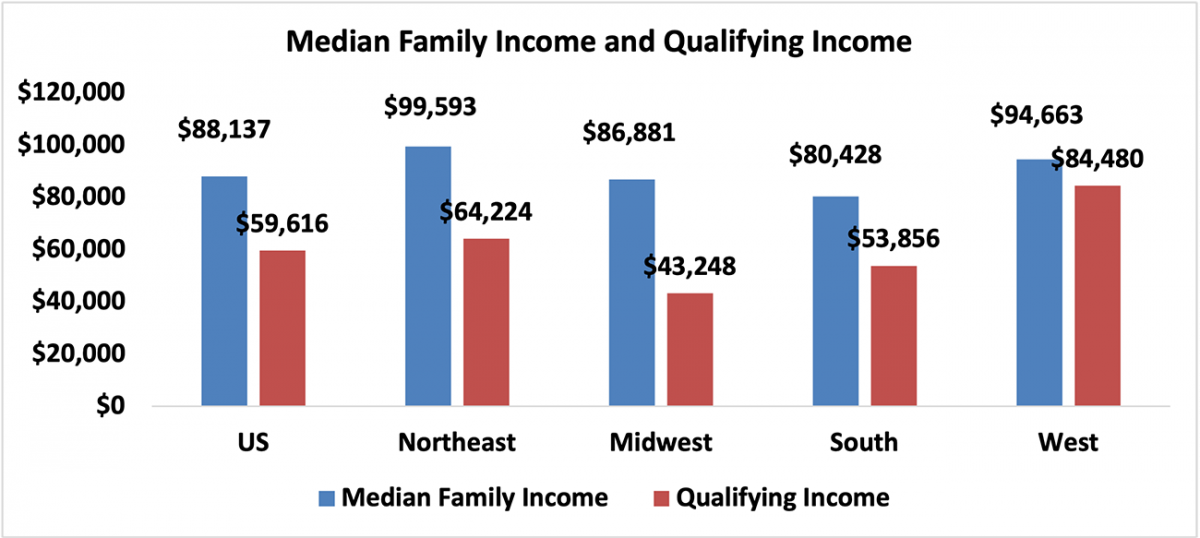

As of November 2021, the nationwide and regional indices have been all above 100, that means {that a} household with the median earnings had greater than the earnings required to afford a median-priced house. The earnings required to afford a mortgage, or the qualifying earnings, is the earnings wanted in order that mortgage funds on a 30-year mounted mortgage mortgage with 20% down cost account for 25% of household earnings.2

Probably the most inexpensive area was the Midwest, with an index worth of 200.9 (median household earnings of $86,881 with the qualifying earnings of $43,248). The least inexpensive area remained the West, the place the index was 112.1 (median household earnings of $94,663 and the qualifying earnings of $84,480). The South was the second most inexpensive area with an index of 149.3 (median household earnings of $80,428 and the qualifying earnings of $53,856). The Northeast was the second most unaffordable area with an index of 155.1 (median household earnings of $99,593 with a qualifying earnings of $64,224).

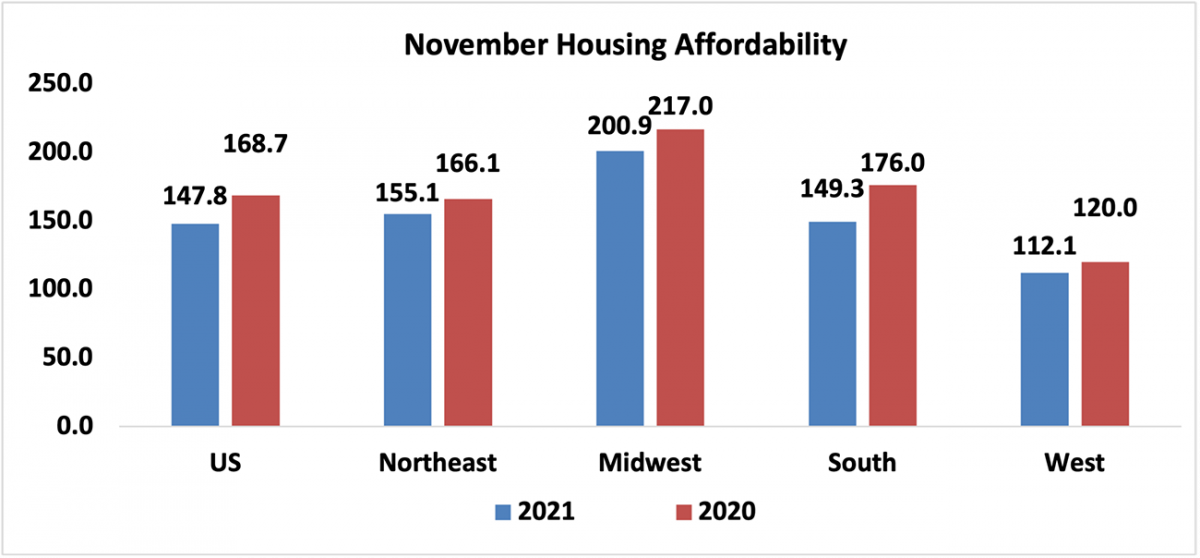

Housing affordability3 declined from a yr in the past in all of the 4 areas. The South had the most important decline of 15.2%. The Midwest area skilled a decline of seven.4%. The West and the Northeast each shared the smallest dip of 6.6%.

Affordability was solely up modestly within the West 0.2% from final month. The Midwest was down modestly 0.1% adopted by the Northeast with a decline of 0.6%. The South had the most important lower of 1.4%.

Nationally, mortgage charges have been 30 foundation level from one yr in the past (one share level equals 100 foundation factors).

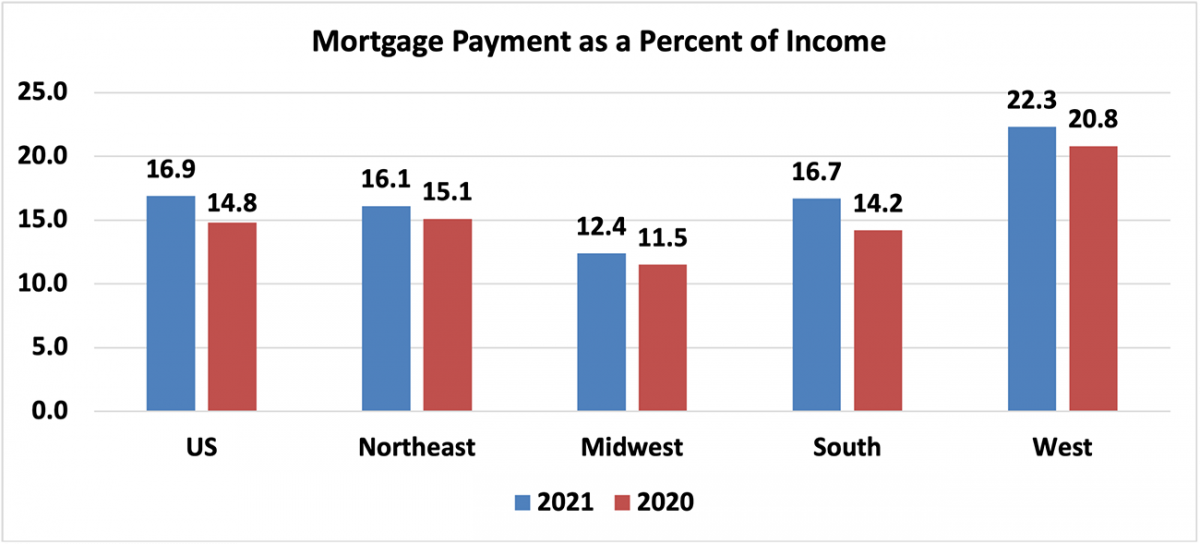

In comparison with one yr in the past, the month-to-month mortgage cost rose to $1,242 from $1,040, a rise of 19.4%, The annual mortgage cost as a share of earnings elevated to 16.9% this November from 14.8% from a yr in the past because of larger house costs and solely modest positive aspects in median household incomes. Regionally, the West has the very best mortgage cost to earnings share at 22.3% of earnings. The South had the second highest share at 16.7% adopted by the Northeast with their share at 16.1%. The Midwest had the bottom mortgage cost as a share of earnings at 12.4%. Mortgage funds will not be burdensome if they’re not more than 25% of earnings.4

This week the MBA reported mortgage functions elevated 1.4% from every week earlier. Mortgage credit score availability elevated in December. Incomes are rising 4.7% whereas house costs are rising 14.9% which is contributing to dampen affordability circumstances. Mortgage charges are nonetheless traditionally low however have been above 3% for the final two months.

What does housing affordability appear like in your market? View the complete knowledge launch.

The Housing Affordability Index calculation assumes a 20% down cost and a 25% qualifying ratio (principal and curiosity cost to earnings). See additional particulars on the methodology and assumptions behind the calculation.

1 Beginning in Could 2019, FHFA discontinued the discharge of a number of mortgage charges and solely revealed an adjustable fee mortgage referred to as PMMS+ based mostly on Freddie Mac Major Mortgage Market Survey. With these adjustments, NAR discontinued the discharge of the HAI Composite Index (based mostly on 30-year mounted fee and ARM) and beginning in Could 2019 solely releases the HAI based mostly on a 30-year mortgage. NAR calculates the 30-year efficient mounted fee based mostly on Freddie Mac’s 30-year mounted mortgage contract fee, 30-year mounted mortgage factors and charges, and a median mortgage worth based mostly on the NAR median worth and a 20% down cost.

2 The 25% mortgage cost to earnings share takes into consideration {that a} house owner has different bills comparable to property insurance coverage, taxes, utilities, and upkeep, in order that complete housing bills are not more than 30% of earnings. Housing prices will not be burdensome in the event that they account for not more than 30% of earnings.

3 A Dwelling Affordability Index (HAI) worth of 100 signifies that a household with the median earnings has precisely sufficient earnings to qualify for a mortgage on a median-priced house. An index of 120 signifies {that a} household incomes the median earnings has 20% greater than the extent of earnings wanted pay the mortgage on a median-priced house, assuming a 20% down cost in order that the month-to-month cost and curiosity is not going to exceed 25% of this degree of earnings (qualifying earnings).

4 Complete housing prices that embrace mortgage cost, property taxes, upkeep, insurance coverage, utilities will not be thought-about burdensome of they account for not more than 30% of earnings.