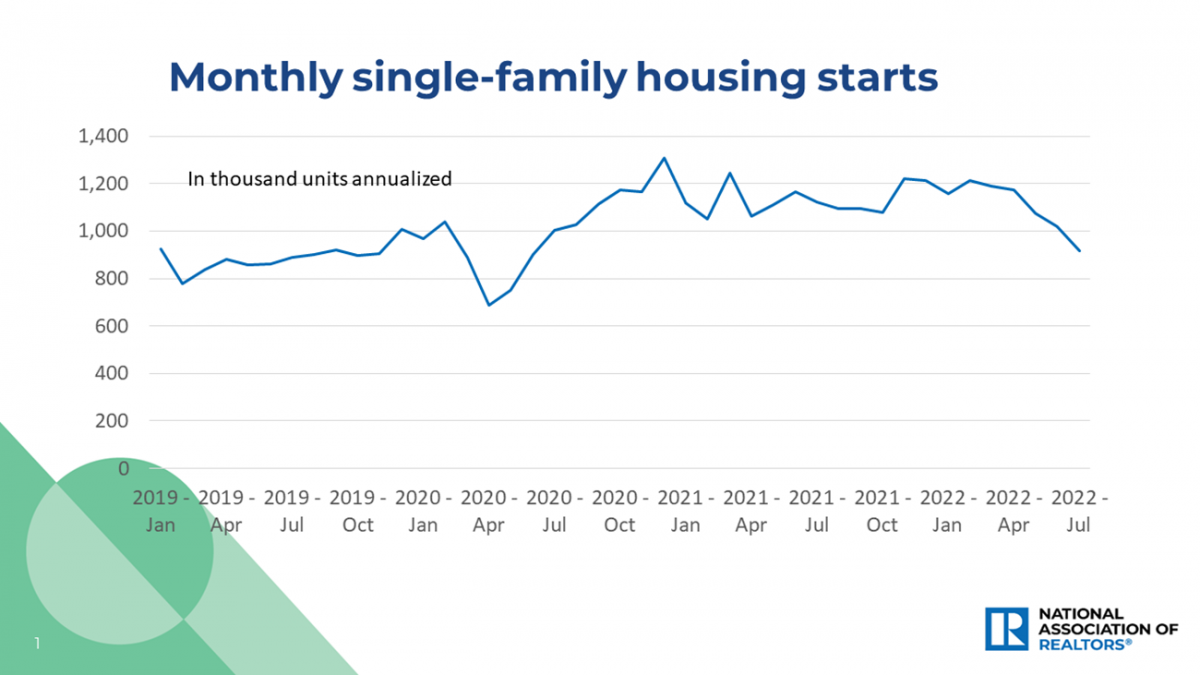

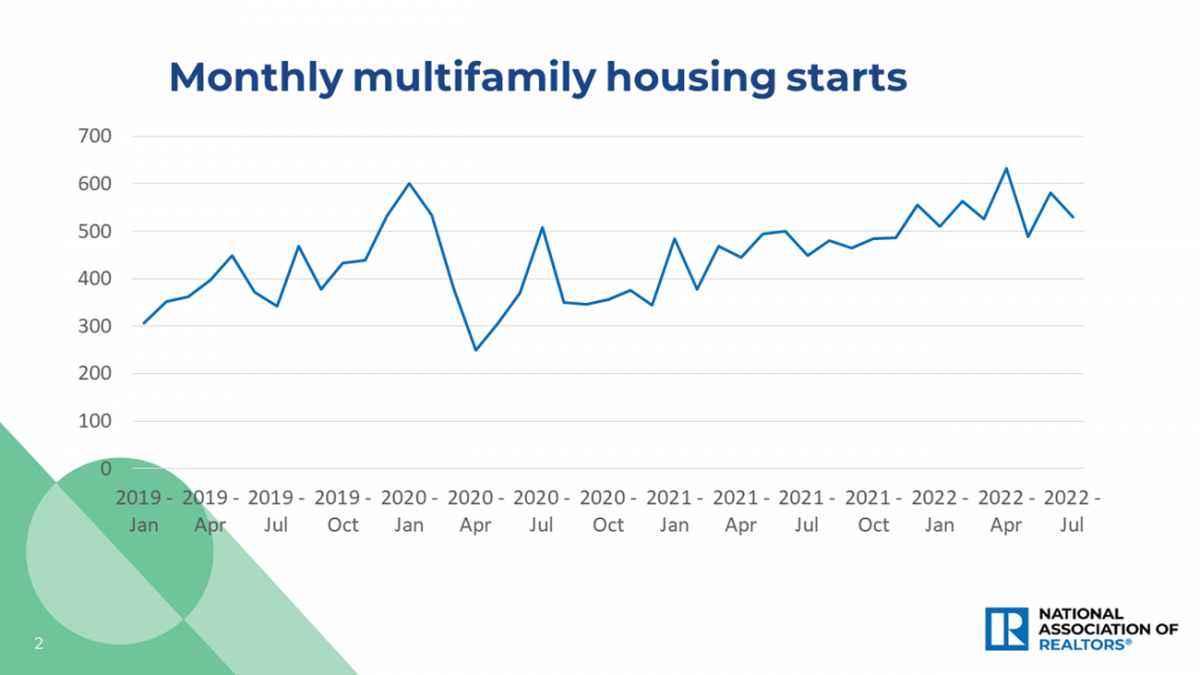

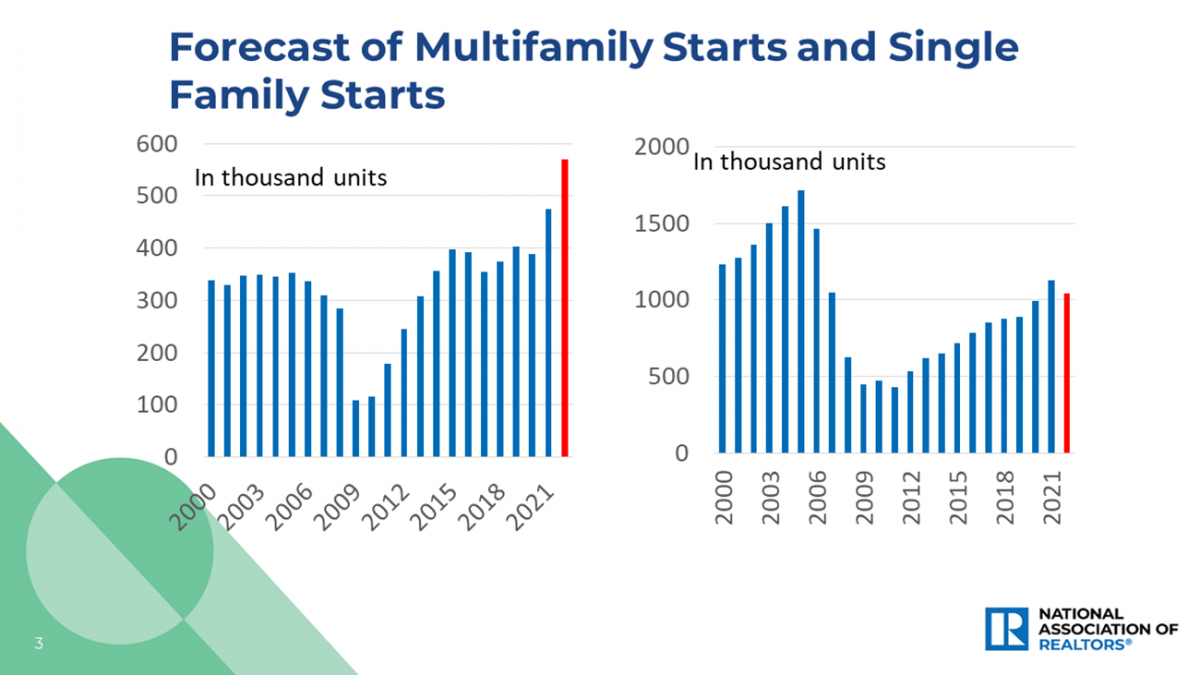

Building begins of each single-family and multifamily housing items fell in July. The decline in single-family begins to 916,000 annualized items is the bottom for the reason that COVID-19 lockdown months within the spring of 2020 and basically matches the annual complete of 888,000 in 2019 earlier than the pandemic. The decline in multifamily begins to 530,000 (from 580,000 within the prior month) may very well be simply the traditional month-to-month volatility in residence buildings. What’s necessary is that multifamily building is on tempo this 12 months to achieve the very best exercise in additional than 30 years. Quickly rising rents are financial incentives for constructing rental housing.

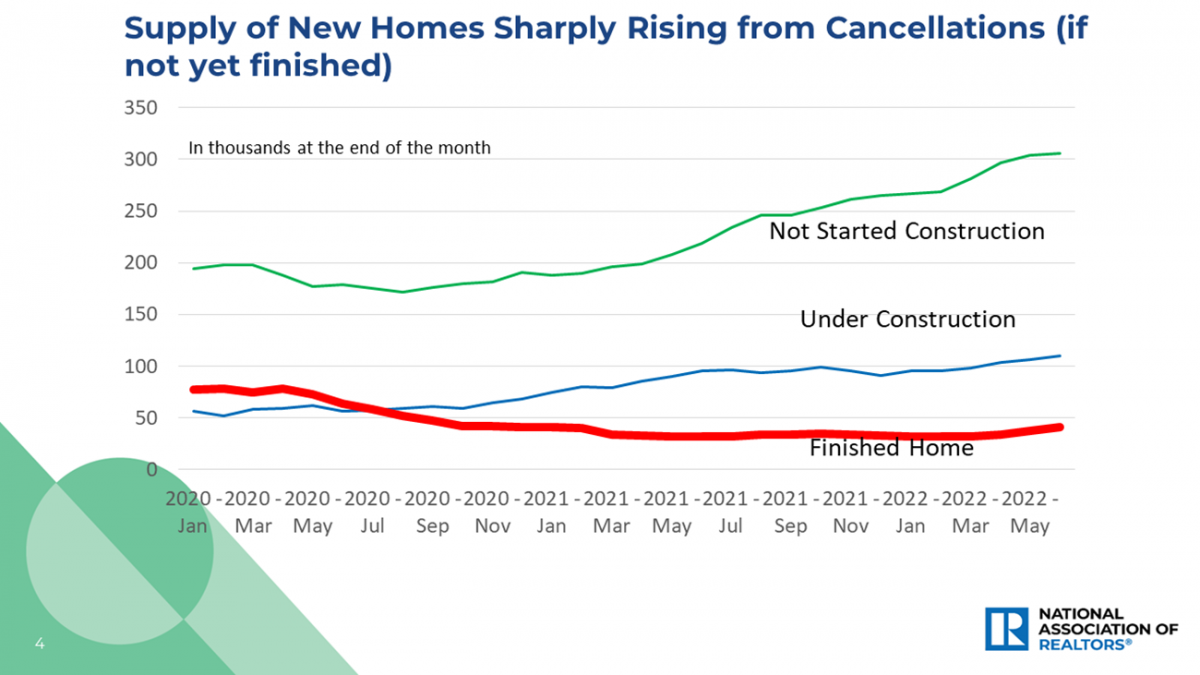

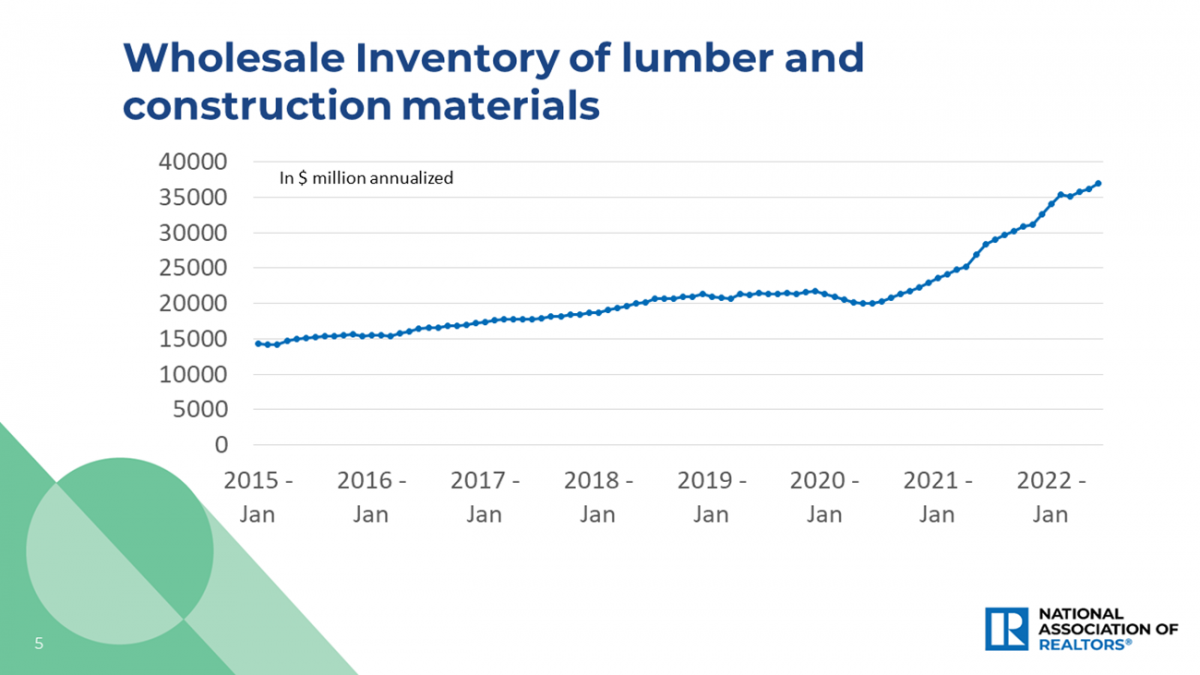

Homebuilders are naturally very cautious about rising unsold stock throughout the building section. However these accomplished houses are discovering consumers inside three months, which is comparatively swift for the brand new houses market. Enhancing circumstances throughout the provide chain for the supply of things resembling lumber and home equipment will reduce general uncertainty. Furthermore, demographics nonetheless counsel a large housing scarcity. If mortgage charges stay close to 5%, after reaching 6% in early June, there may very well be renewed purchaser exercise and extra stock declines. Half of present houses can nonetheless command the complete itemizing worth.