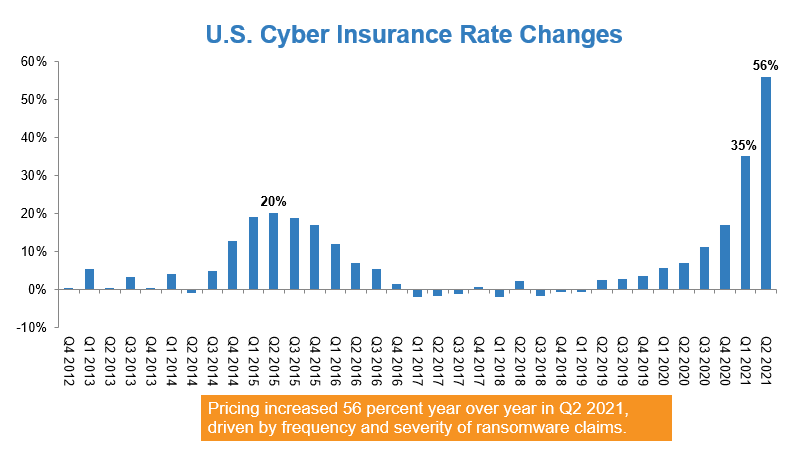

Growing cybercrime incidents leading to giant losses – mixed with some carriers retreating from writing the protection – is driving cyber insurance coverage premiums sharply increased.

As soon as a diversifying secondary line and one other endorsement on a coverage, cyber has grow to be a main part of any company’s risk-management and insurance-buying choices. In consequence, insurers must evaluation their urge for food for the peril, threat controls, modeling, stress testing and pricing.

According to A.M. Best, the prospects for the cyber insurance coverage market are “grim” for a number of causes:

- Fast development in publicity with out sufficient threat controls,

- Rising sophistication of cyber criminals, and

- The cascading results of cyber dangers and a scarcity of geographic or business boundaries.

Whereas the business is nicely capitalized, A.M. Greatest says particular person insurers who enterprise into cyber with out completely understanding the market can put themselves in a susceptible place.

“The cyber insurance coverage business is experiencing an ideal storm between widespread know-how threat, elevated rules, elevated felony exercise, and carriers pulling again protection,” according to Joshua Motta, co-founder and CEO of Coalition, a San Francisco-based cyber insurance coverage and safety firm. “We’ve seen many carriers sublimit ransomware protection, add coinsurance, or add exclusions.”

Worsening because the pandemic

A recent Willis Towers Watson study discovered main and extra cyber renewals averaging premium will increase “nicely into the double digits.” One issue serving to to drive these will increase, Willis writes, is the sudden shift towards distant work on probably less-secure networks and {hardware} in the course of the pandemic, which has made organizations extra susceptible to phishing and hacking.

The common value of a knowledge breach rose 12 months over 12 months in 2021 from $3.86 million to $4.24 million, according to a recent report by IBM and the Ponemon Institute — the very best within the 17 years that this report has been printed. Prices had been highest in america, the place the common value of a knowledge breach was $9.05 million, up from $8.64 million in 2020, pushed by a fancy regulatory panorama that may differ from state to state, particularly for breach notification.

The highest 5 industries for common complete value had been:

- Well being care

- Monetary

- Prescribed drugs

- Know-how

- Vitality

For the well being care sector, the common complete value rose 29.5 %, from $7.13 million in 2020 to $9.23 million in 2021.

For the reason that begin of the 12 months, cyber insurance coverage charges have elevated 7 % for small companies, according to AdvisorSmith Solutions. For midsize and enormous companies, AdvisorSmith mentioned, these will increase had been nearer to twenty %.

Insurers’ reactions

AIG last month said it’s tightening phrases of its cyber insurance coverage, noting that its personal premium costs are up almost 40 % globally, with the biggest improve in North America.

“We proceed to rigorously cut back cyber limits and are acquiring tighter phrases and circumstances to handle rising cyber loss developments, the rising menace related to ransomware and the systemic nature of cyber threat typically,” CEO Peter Zaffino mentioned on a convention name with analysts.

In Could, AXA said it might cease writing cyber insurance policies in France that reimburse clients for extortion funds made to ransomware criminals. In a ransomware assault, hackers use software program to dam entry to the sufferer’s personal information and demand cost to regain entry.

The FBI warns in opposition to paying ransoms, however research have proven that enterprise leaders at the moment pay loads within the hope of getting their information again. An IBM survey of 600 U.S. enterprise leaders discovered that 70 % had paid a ransom to regain entry to their enterprise recordsdata. Of the businesses responding, almost half have paid greater than $10,000, and 20 % paid greater than $40,000.

Two advisories final 12 months from U.S. Treasury companies – the Financial Crimes Enforcement Network (FinCEN) and the Office of Foreign Assets Control (OFAC) – indicated that corporations paying ransom or facilitating such funds may very well be topic to federal penalties. These notices underscore companies’ must seek the advice of with educated, respected professionals lengthy earlier than an assault happens and earlier than making any funds.

Extra like terror than flood

Cyber threat is not like flood and fireplace, for which insurers have many years of information to assist them precisely measure and value insurance policies. Cyber threats are comparatively new and always evolving. The presence of malicious intent ends in their having extra in frequent with terrorism than with pure catastrophes.

Insurers and policyholders must be companions in mitigating these dangers by constantly enhancing information hygiene, sharing of intelligence, and readability as to protection and its limits.