Max Dorfman, Analysis Author, Triple-I

Per- and Polyfluoroalkyl Substances (PFAS)—a varied group of human-made chemicals utilized in an array of client and industrial merchandise—present a new potential liability for insurers, as U.S. regulatory exercise continues to alter, with lawsuit outcomes indicating this is a matter that can proceed to develop.

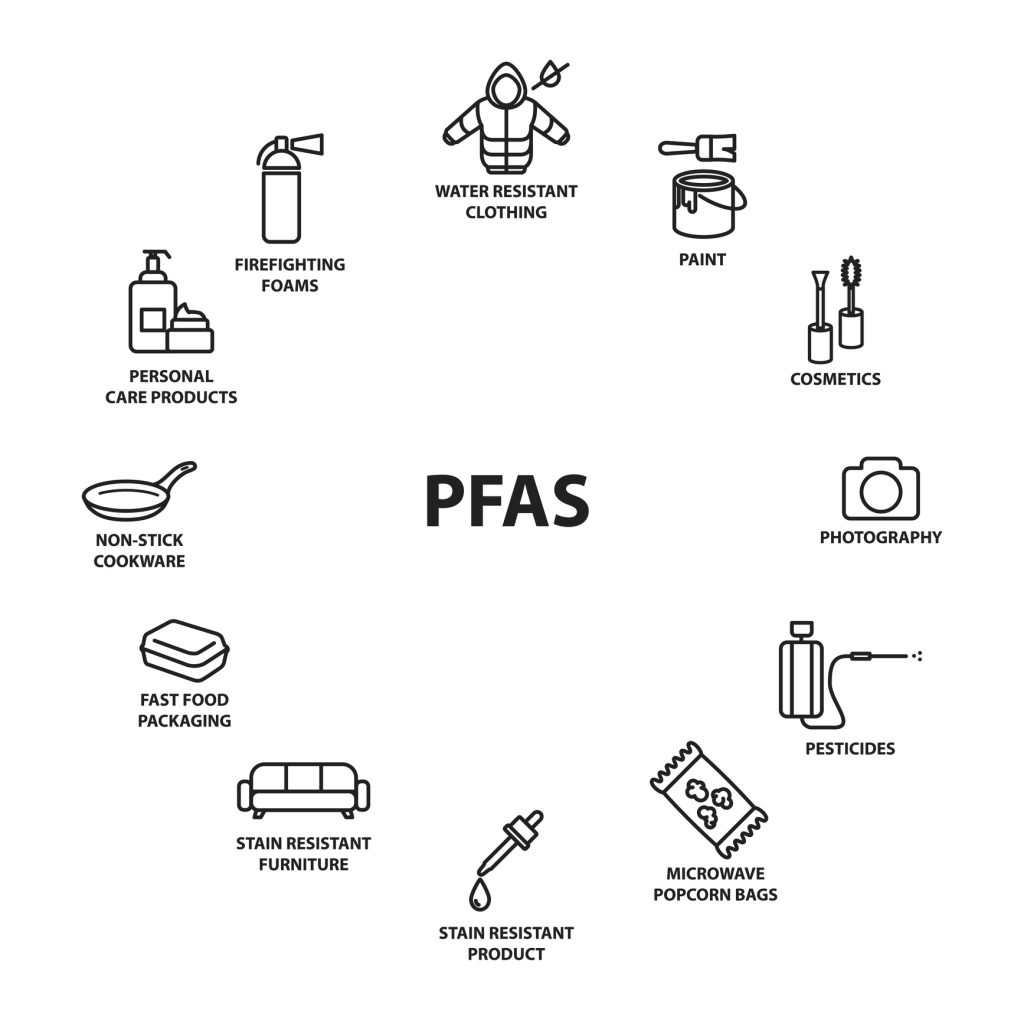

PFAS, which have existed for the reason that Nineteen Thirties, are creating concern due to how ubiquitous they’re, in addition to their potential to hurt individuals’s lives. They’re utilized in every little thing from Teflon coatings to meals packaging to firefighting foam, resulting from their capability to withstand oil and moisture. These qualities are additionally doubtlessly damaging as a result of they usually keep within the human physique, by no means fully breaking down.

Although research surrounding PFAS should not conclusive, they’ve been related to most cancers, pregnancy-induced hypertension, and thyroid illness. Their pervasiveness means everybody doubtless has some quantity of PFAS of their blood stream. There’s worry about their presence in water provides, as properly.

“PFAS are water soluble and dissolve readily in soil,” said Cindy Wilk, International Environmental Legal responsibility Skilled, Allianz Danger Consulting at AGCS. “An industrial accident or firefighting incident can lead to their launch into water sources, making native communities weak, however PFAS can even migrate shortly via groundwater pathways to infect areas removed from their authentic supply.”

PFAS litigation continues to rise

PFAS litigation has seen large development over the previous 20 years, starting with a lawsuit filed towards DuPont, the corporate that makes Teflon. DuPont was accused of contaminating water from a plant in West Virginia—resulting in a settlement to supply as much as $235 million for medical monitoring of over 70,000 individuals. A number of related lawsuits have adopted.

As of 2021, greater than 5,000 PFAS-related complaints have been filed in 40 courts, with 193 defendants in 82 industries.

Moreover, in 2021, the PFAS Action Act handed the Home and set the Environmental Safety Company (EPA) on the latest course towards creating new PFAS requirements. The act doesn’t embrace a legal responsibility exception for water-wastewater utilities, even supposing these entities should not the supply of PFAS, thus inflicting concern that they would be the goal of civil litigation

How can insurers reply?

Though the Insurance coverage Providers Workplace (ISO) has not produced a PFAS-specific exclusion for industrial legal responsibility insurance policies, work is being completed on a draft exclusion, which may very well be revealed in late 2022. With that course of nonetheless underway, a number of PFAS-related exclusions are circulating, some as a modification to the Whole Air pollution Exclusion or by establishing a stand-alone PFAS exclusion. Nonetheless, insurers should be cautious of the potential liabilities, because the Biden Administration’s regulatory deal with PFAS may result in increased litigation.

Reinsurer Gen Re recommends that insurers:

- Take stock of beforehand underwritten dangers;

- Fastidiously take into account new dangers at submissions; and

- Preserve abreast of PFAS, each as to scientific developments and the litigation that it spawns.