Owners’ insurance coverage premium charges have risen considerably for the reason that pandemic and are more likely to maintain growing. It’s essential for customers and policymakers to know why that is occurring and why it’s more likely to proceed, so Triple-I has revealed an Points Temporary on the subject.

From 2017 by 2021, premium charges are up 12.2 p.c on common nationwide, based on S&P World Market Intelligence knowledge. A lot of this may be attributed to pandemic-related supply-chain points and labor shortages driving up the price of house repairs and substitute.

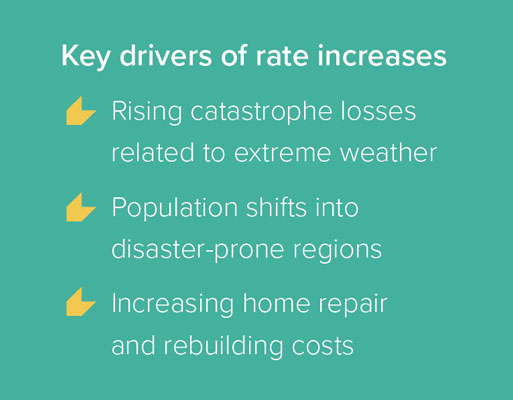

However, because the Points Temporary reveals, longer-term developments are in play – most importantly, greater than 40 years of rising pure disaster losses. Common insured cat losses are up roughly 700 p.c for the reason that Nineteen Eighties, due partially to elevated frequency and depth of occasions and to inhabitants shifts into disaster-prone areas. The temporary cites U.S. Census Bureau knowledge exhibiting that the variety of housing models in the US has elevated most dramatically since 1940 in areas most susceptible to climate and climate-related injury.

It additionally reveals that householders’ insurance coverage premium charges have usually trailed will increase in house substitute prices. Because of this, householders’ protection has been an unprofitable enterprise line for insurers in recent times – an unsustainable long-term development that has been exacerbated by the pandemic’s disruption of the provision chain and the worldwide financial system.

Be taught Extra

Flood: Past Threat Switch

Hurricane Season: Extra Than Simply Wind and Water

Combating Wildfires With Innovation

Info + Statistics: Owners’ and Renters’ Insurance coverage

For much more sources, take a look at Triple-I’s Resilience Accelerator.