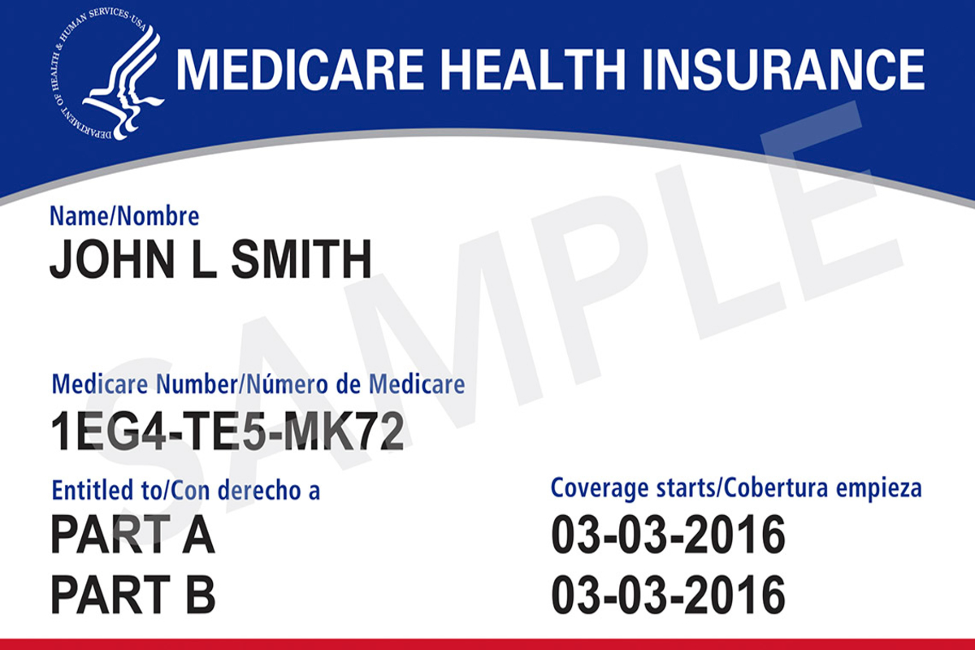

Your health-care protection and your nationwide identification card function proof of safety. Once you go to the doctor, the hospital, or one other supplier you might use your medical insurance card. Nonetheless, it’s a useful information that exhibits you ways a lot you could have to spend. Figuring out your card will help you in budgeting for medical payments and receiving the providers you want in accordance with your calls for. A well being insurance coverage card serves as proof that you’re coated by medical insurance. It contains paperwork that can be utilized by your native clinic to acquire cost out of your insurance coverage supplier. Initially, docs/ medical consultants will deal with you as a affected person, they usually make a replica of your insurance coverage card.

A happier worker is a excessive performer, and having a cheerful employee is crucial to each firm’s long-term progress. Any firm’s major purpose is to generate income, which might solely be completed if every worker provides all she or he has to his or her work.

Worker well being care isn’t any extremely essential; additionally it is a should for hiring and retaining proficient jobs. In actuality, nearly all of employers agree that well being care is probably the most worthwhile service supplied by their employer. That’s as a result of, for quite a lot of causes, many people don’t work out non-public well being care insurance policies. Many companies, however, lack the time or cash to do healthcare supply on their very own, which is the place we step in.

Insurance coverage suppliers use your credit score scores to find out whether or not or to not cowl you and the way a lot your premium could be. And the truth that they use your credit score historical past to make assumptions about you, they don’t disclose immediate or late transactions to the credit score reporting businesses, as a result of insurance coverage funds don’t have any bearing in your credit score rating.

Largely throughout powerful COVID-19 illness, hundreds of Households have misplaced their sources of income, and with it, their freedom to pay for requirements equivalent to well being care. They’re going through a variety of issues paying their well being premium as a consequence of worse circumstances. It’s nonetheless essential to have entry to well being care, however this can be very vital now.

Not just for preventive care but additionally for testing and therapy of the quite a few ailments like a devastating illness nowadays. Medical insurance covers the vary of physicians, nurses, and different well being care providers you go to. Residents who’re going through severe ailments, equivalent to diabetes and elevated blood stress, ought to be insured not simply as they’re extra vulnerable to a extreme incident of COVID-19, but additionally as a result of they’re extra prone to infect individuals.

Nonetheless that 75 % of current circumstances of kidney illness are attributable to these persistent sicknesses. Insurance coverage is crucial for sustaining the standard of therapy and addressing persistent ailments. So we should always perceive the higher insurance policies of insurance coverage and in addition respect them accordingly. Many well being care insurance policies have a ready clause, which lets you maintain seeing your physicians for a sure length of time till your protection is canceled. In these conditions, you solely have a couple of days after the deadline to pay your charge.

A number of international locations have gone additional to mandate insurers to incorporate grace intervals on the well being care insurance policies they management, this will embody QHPs, small group insurance coverage suppliers, employer-based well being plans, and Medicare complement plans.

In respect to the dearth of presidency insurance policies and legislations, some counties have issued briefings instructing insurance coverage suppliers to grant registration necessities, making certain {that a} affected person’s medical insurance is not going to be canceled as a consequence of nonpayment throughout emergencies. Additionally, after the emergency finishes, these municipal authorities’ directives often compel the insured to allow prospects to pay again premiums in installments. Examine the Affiliation And the nationwide Insurance coverage Collectors’ state web site and see if there are any laws ordered by your state or particular area to the medical insurance supplier to have a time restrict.

Any fees laid throughout the 1st month of the APTC timeline should be paid. As an alternative of protecting premiums through the second two months of the evaluate interval, insurers maintain them and advise hospitals that the affected person has not paid the funds but. The insurer will disenroll the affected person within the case when the affected person has additionally not paid the charge for 3 months.

Nearly all of transplant sufferers are coated by Medicare. Many will nonetheless want a Medicare Supplemental Insurance coverage package deal to help it with out bills. Medigap plans for these above the age of 65 are solely coated by authorities affected person rights. A number of sides of Medigap are managed by the jurisdictions, about whether or not suppliers are required to promote sure providers to Medical practitioners underneath the age of 65. So some issues are essential to be famous down when going to make sure premium well being care. You need to observe the directions of the respective organizations to safe your insurance coverage.

When your medical insurance package deal was canceled as a consequence of late funds, it’s best to know what’s going to happen to your excellent medical bills, and the medical insurance coverage subsidy, and your choices for locating new healthcare protection.

When you could have your insurance policies, you could have a redemption interval for past-due funds, however the length of the grace interval is set by whether or not you may get a premium tax credit score to make you cash for the coverage you bought in Reasonably priced Healthcare.

The timeframe is 90 days in case you are incomes a premium tax refund and have already charged your first insurance coverage cost to start protection. If you happen to don’t (that’s, for those who pay most charges for the public sale or solely by a well being insurer), your time-frame might be restricted to only one month.

- The insurance coverage settled by you might be canceled in a state of affairs to not in a position to pay your earlier funds earlier than the grace interval’s finish. When you have a 90-day wait interval, your insurance coverage will expire after the 1st day of the month after the closure of your time restrict.

- Beneath different phrases, you’ll have had a full month of protection—however needless to say the quantity might be redelivered to the authority for the insurance coverage subsidy that was billed in your aspect for that particular month while you file your revenue.

- In different phrases, you’ll have had such an entire time length of protection however keep in mind that the stability might be redirected to the regulator for the premium subsidy that was paid in your behalf for that very same month/ days while you submit your expense report.

On this case, there appears to be a danger that any medical payments out of your final insurance coverage protection might be returned to you unpaid. Once you earned healthcare advantages when within the 2nd or third month of being behind due to the healthcare premiums, here’s what applies, or for those who earned medical therapy in these days when your premium well being care was too late and you weren’t getting profit from receiving the cash.

Standing of medical insurance might be subjected as pending in case when you could have did not pay the earlier tax funds of premium insurance coverage. When you’ve been having bother paying your well being care premium for greater than 1 month. As an alternative of submitting and protecting these premiums, the insurance coverage agency places them on monitor because it intends so that you can transfer forward on the insurance coverage premiums for the analysis. When you’ll not pay sufficient, your medical insurance might be canceled mechanically inside 3 months. The termination will take impact on the finish of every month during which relying upon your premium and its complete overview evaluation.

You received’t be compensated for the waiver your outdated healthcare plan acquired with the in-network employer when your medical insurance was canceled retroactively on the day you had been a couple of month late. Once you acquired the therapy, you grew to become successfully unprotected. Excluding any of the system reductions, the invoice could possibly be significantly extra.

The identical is the state of affairs when you don’t get insurance coverage reimbursement and due to this fact don’t pay your premium healthcare till the final of the time restrict, your whole protection will ship again to you by an insurance coverage agent by the tip day. And all appeals you had all through a few weeks’ wait interval might be denied.

Probably the most antagonistic factor you are able to do for those who suspect something might occur to you is to do nothing. Be constructive in your method. Attain an settlement along with your service insurer till your medical insurance premium is canceled. Since many lenders ship past-due funds to bank card firms, failing to behave now might hurt your credit score historical past and make it tougher to acquire credit score within the upcoming days.

Keep sincere and inform all of the issues really about your situation whereas approaching the insurance coverage agent in regards to the excellent invoice. So your credibility stays heading in the right direction. A number of medical professionals would comply with monetary preparations and they’ll wish to be billed steadily relatively than by no means. Making offers on a cost schedule can assist you keep away from having your invoice turned over to a finance firm. If you happen to obtained therapy from a significant establishment, equivalent to a physician, inquire about peer choices or some circumstances speak about charity and different donations.

A number of punishments or penalties are imposed for being uninsured from 2014 to 2018 in several areas of the world. The tax was calculated and relies upon upon the month-to-month revenue and monetary assets and the variety of months you go with out well being care for no less than 1 day. As of 2019, the wonderful has been dropped to a minimal which means those that are disabled not face penalties on their taxable earnings.

You may be included in a grace cycle if you don’t pay the invoice on time. You may be unable to pay for the well being care advantages you rendered after your grace time if not acquired any reimbursement. Besides in case your contract has certainly been canceled, we’ll resume service as quickly as your bill is acquired in complete. Between 3 months of the grace interval, whether or not you’re qualifying for and accumulating the Accelerated Insurance coverage Tax Credit score, the claims could be assessed in another way than regular.

- Your declare might be paid as regular through the thirty days of time-frame.

- The circumstances might be pending for the beginning months. That confirms there might be owned by us with out being charged or refused. Any arguments from pharmacies might be denied. You’ll must cost for them your self.

- You’ll be answerable for any pending lawsuits for those who go for 90 days with out paying in complete.

As soon as a service has been performed and the supplier has paid us for this service, a retroactive rejection might come up. When a declare is denied retroactively, it’s referred to as a retroactive denial.

- Arguments are paused throughout the latest months of a ready interval if the participant doesn’t settle their charge in a urged time restrict to handle insurance coverage. For fees denied by the plan, the member could be left accountable for the expense of providers.

- Signatories are obligatory for a facility, however no order for a evaluate to evaluate scientific want has been submitted.

- The revenue has been used up and the merchandise have been rendered.

- You need to have an thought to pay your insurance coverage on time.

- In circumstances the place approval is required, attempt to make sure your insurance coverage agent has supplied the right paperwork.

- Be certain you perceive the benefits and don’t use them till you’re sure your packages are a revenue.

You’ll forfeit your coverage advantages if you don’t afford your premiums and the grace time on insurance policies supplied in a medical insurance program has expired.

The Consolidated Omnibus Finances Reconciliation Act provides you the constitutional freedom to remain on an outdated employer’s collective well being care package deal for a hard and fast period of time following a job loss in California and another components o Canada. COBRA could also be a fast repair, but it surely comes with a price ticket.

When your premium well being care premium is due, for a restricted interval. So this requires a brief interval of 90 days. If you happen to haven’t paid your invoice but, you could have till the tip of the interval to take action to maintain your medical insurance.

There isn’t a basic ban in opposition to coated or plan representatives canceling their well being care advantages or inclusion in a well being profit plan. There are not any powerful guidelines for these circumstances. Other than that, there are not any monetary penalties of canceling well being care protection. You’ll not get the premium service return in case to demolish the coverage of well being care protection.

Your schedule might be canceled if you don’t comply. In lots of conditions when you find yourself not in a position to pay your invoice in time on your first cost, you’ll get a grace interval. By the shut of the ready interval, you’ll must pay for all the pieces you cost. You may lose your insurance coverage coverage for those who wouldn’t.

The price of your well being care protection premium is obvious as a result of most individuals’s pay relies on a month. The contribution you give to your well being care supplier to maintain your coverage lively known as a charge. Copayments, self-insured, and reimbursements are among the most seen well being care payments.

When you could have two insurance coverage from two separate corporations and also you terminate one in every of them however don’t pay the opposite, they may almost certainly refer you to cost authorities and may take actions in accordance with the jurisdiction in opposition to you, equivalent to suing you. The circumstances will decide whether or not you can be held accountable. It’s attainable that the truth that you “quickly suspended it later” is contributing to the difficulty. So it’s best to observe the instruction in accordance with the corporate liabilities after which observe these guidelines. In any other case, it’s important to face penalties in case you are did not submit the medical insurance premium in accordance with the urged interval.