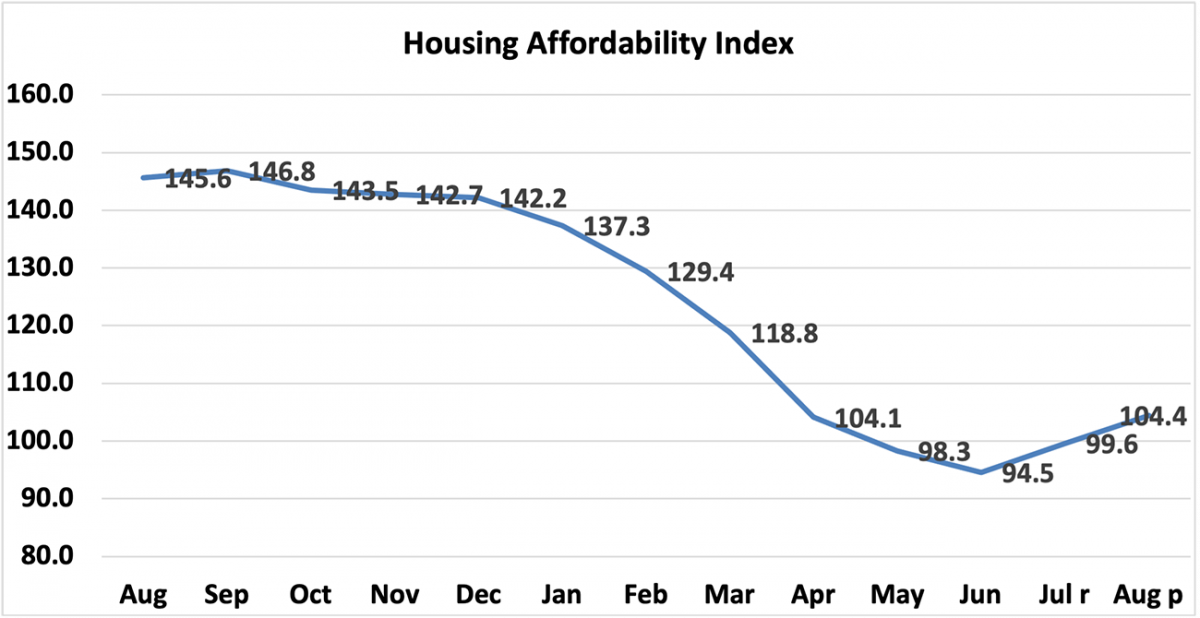

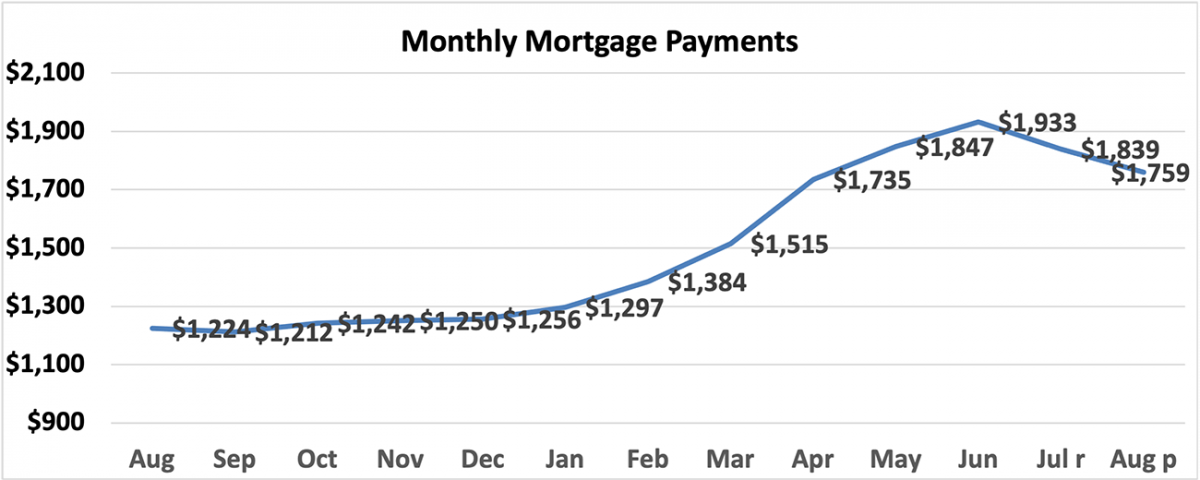

On the nationwide degree, housing affordability improved in August in comparison with the earlier month, in line with NAR’s Housing Affordability Index. In comparison with the prior month, the month-to-month mortgage cost decreased by 4.4% whereas the median household revenue elevated by 0.3%, making dwelling shopping for extra inexpensive in August. Nonetheless, affordability continues to be considerably down from a 12 months in the past.

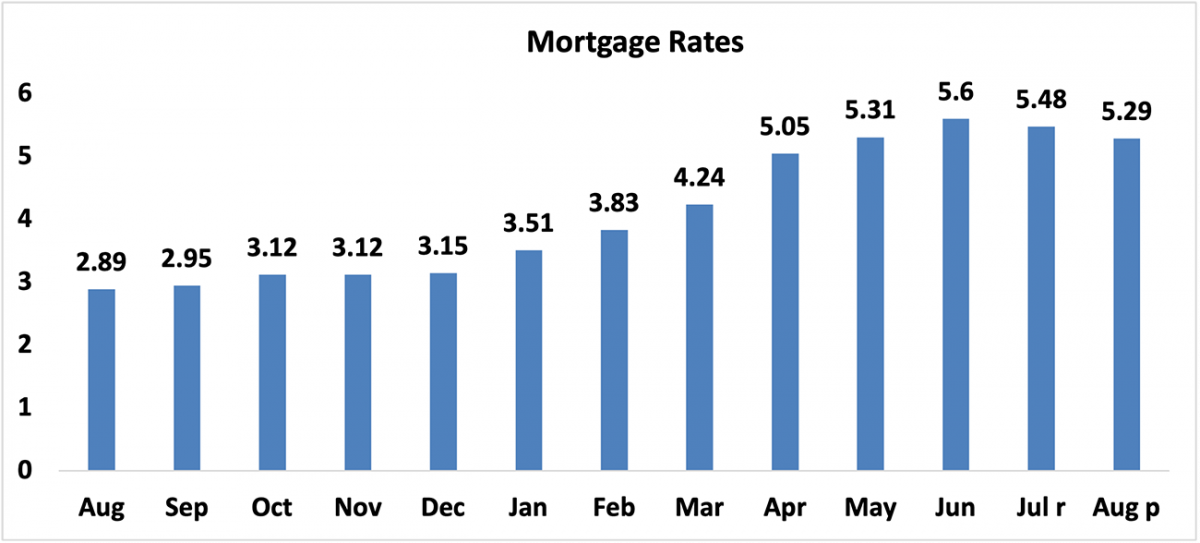

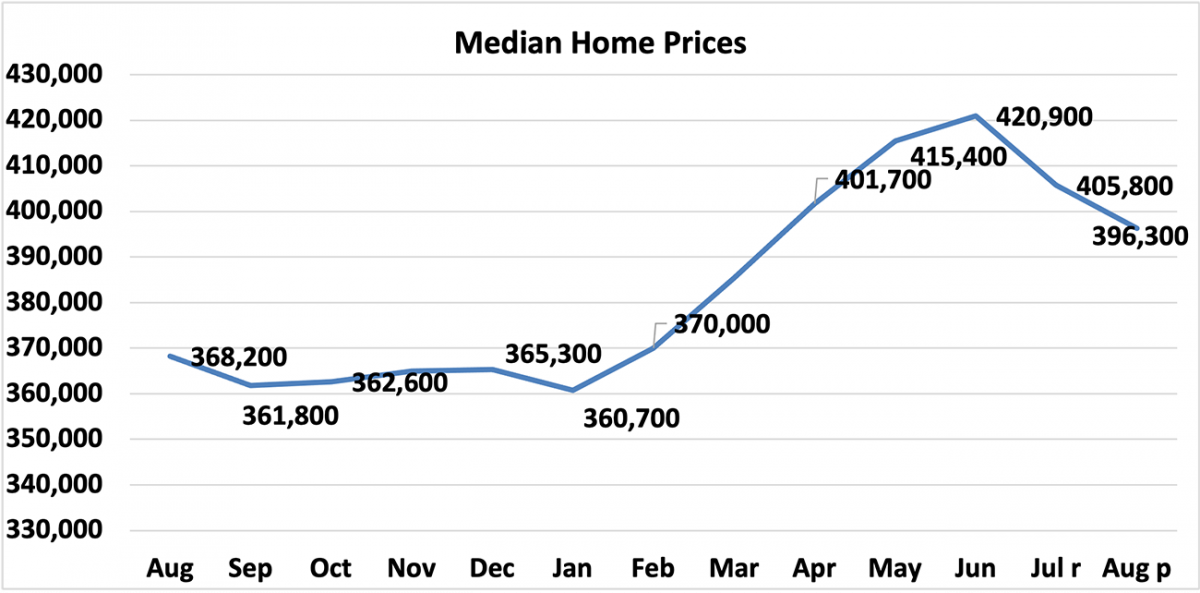

In comparison with one 12 months in the past, affordability fell in August because the month-to-month mortgage cost climbed 43.7% and median household revenue rose by 3.1%. The efficient 30-year mounted mortgage charge1 was 5.29% this August in comparison with 2.89% one 12 months in the past, and the median existing-home gross sales value rose 7.6% from one 12 months in the past.

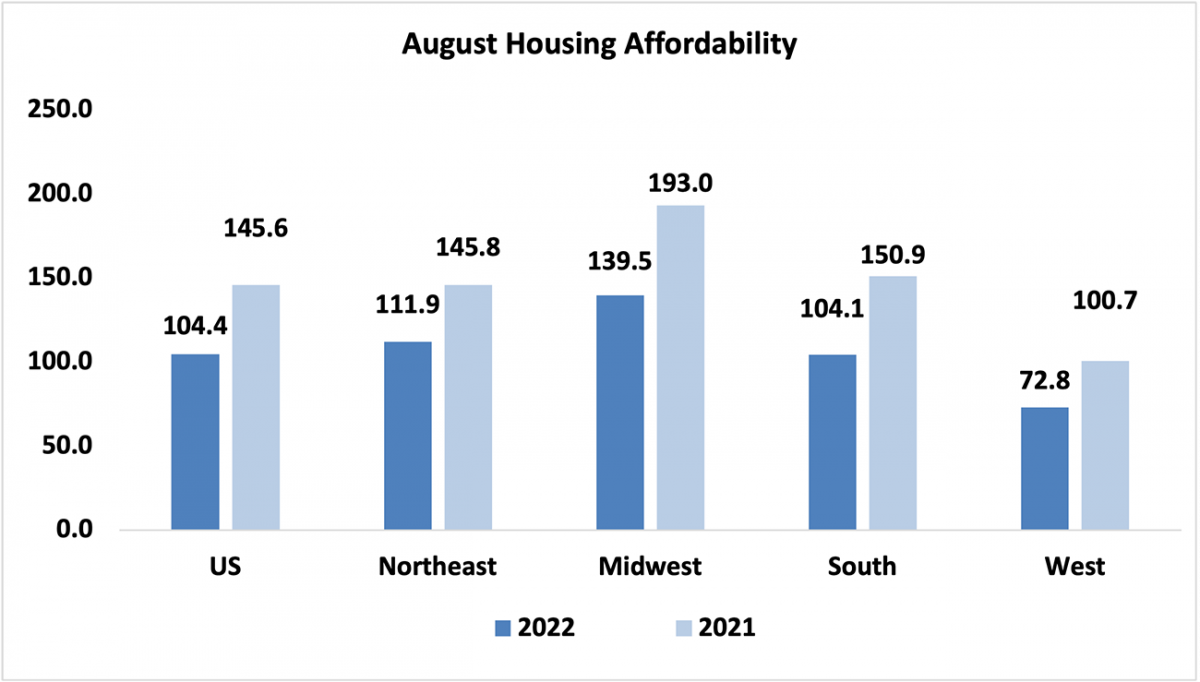

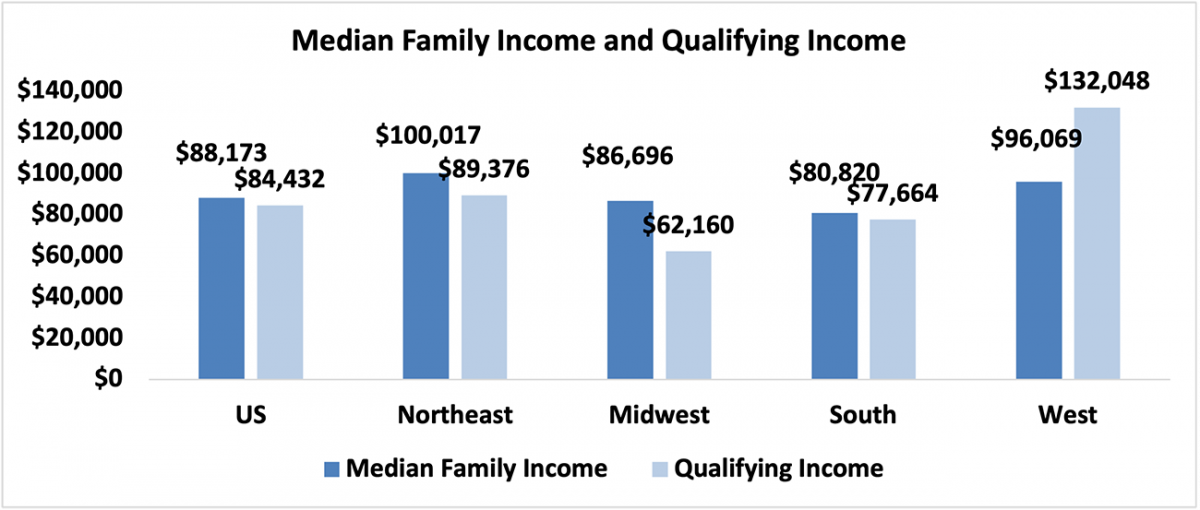

As of August 2022, the nationwide and regional indices had been all above 100, besides within the West, the place the index was 72.8. An index above 100 implies that a household with a median revenue had greater than the revenue required to afford a median-priced dwelling. The revenue required to afford a mortgage, or the qualifying revenue, is the revenue wanted in order that mortgage funds on a 30-year mounted mortgage mortgage with a 20% down cost account for 25% of household revenue.2 Essentially the most inexpensive area was the Midwest, with an index worth of 139.5 (median household revenue of $86,696 with a qualifying revenue of $62,160). The least inexpensive area remained the West, the place the index was 72.8 (median household revenue of $96,069 and the qualifying revenue of $132,048). The Northeast was the second most inexpensive area with an index of 111.9 (median household revenue of $100,017 and the qualifying revenue of $89,376). The South was the second most unaffordable area with an index of 104.1 (median household revenue of $80,820 with a qualifying revenue of $77,664).

A mortgage is inexpensive if the mortgage cost (principal and curiosity) quantities to 25% or much less of the household’s revenue.2

Housing affordability3 had double-digit declines from a 12 months in the past in all 4 areas. The South had the most important decline of 31.0%. The Midwest and West each skilled a weakening in value progress of 27.7%. The Northeast had the smallest dip of 23.3%.

Affordability was up in all areas from final month. The Northeast area rose 10.5%, adopted by the Midwest with an incline of 4.1%. The West was up 4.0%, adopted by the South, which had the smallest enhance of three.8%.

Nationally, mortgage charges had been up 240 foundation factors from one 12 months in the past (one proportion level equals 100 foundation factors) from 2.89% to five.29%.

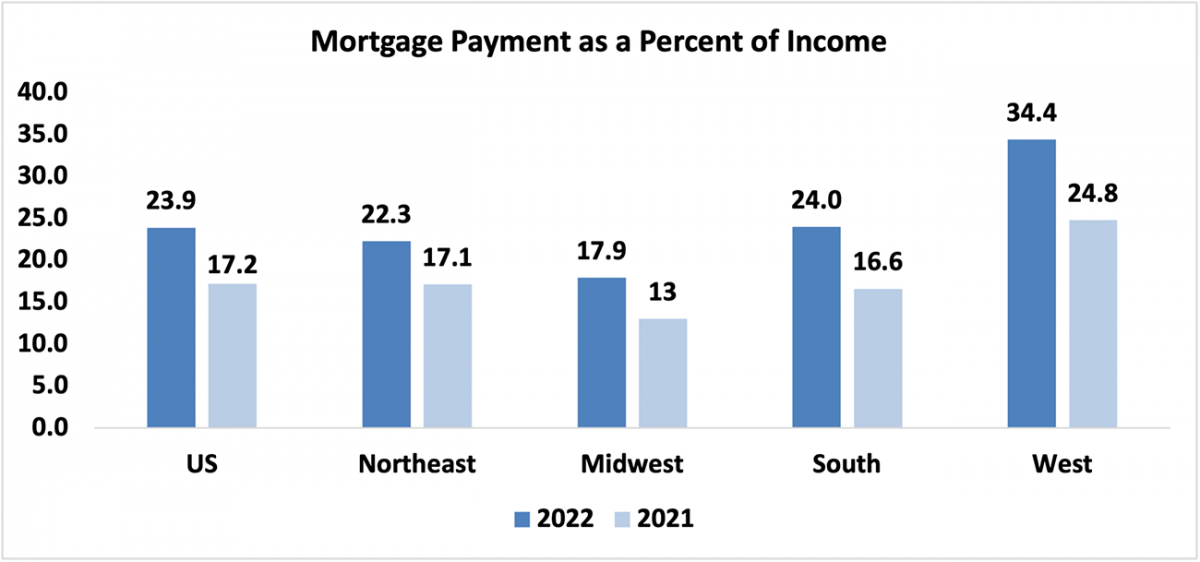

In comparison with one 12 months in the past, the month-to-month mortgage cost rose to $1,759 from $1,224, a rise of 43.7%. The annual mortgage cost as a proportion of revenue inclined to 23.9% this August from 17.2% from a 12 months in the past—largely as a consequence of increased mortgage charges. Regionally, the West has the very best mortgage-payment-to-income share at 34.4% of revenue. The South had the second-highest share at 24.0%, adopted by the Northeast with a share of twenty-two.3%. The Midwest had the bottom mortgage cost as a proportion of revenue at 17.9%. Mortgage funds should not burdensome if they’re not more than 25% of revenue.4

Final week, the Mortgage Bankers Affiliation launched information exhibiting that mortgage purposes decreased by 2% from one week earlier. Mortgage charges stay above 5% however have declined within the earlier two months. Month-to-month mortgage funds have additionally been on the decline in previous months, placing much less burden on incomes. Dwelling costs are nonetheless rising 7%, however the median household dwelling value was underneath $400,000 for the primary time since March of this 12 months. A rise in housing stock and value declines in sure markets will assist potential owners enhance their probabilities of shopping for a house.

See the info launch.

The Housing Affordability Index calculation assumes a 20% down cost and a 25% qualifying ratio (principal and curiosity cost to revenue). See additional particulars on the methodology and assumptions behind the calculation.

1 Beginning in Might 2019, FHFA discontinued the discharge of a number of mortgage charges and solely revealed an adjustable-rate mortgage referred to as PMMS+ based mostly on Freddie Mac Major Mortgage Market Survey. With these adjustments, NAR discontinued the discharge of the HAI Composite Index (based mostly on 30-year mounted charge and ARM) and beginning in Might 2019 solely releases the HAI based mostly on a 30-year mortgage. NAR calculates the 30-year efficient mounted charge based mostly on Freddie Mac’s 30-year mounted mortgage contract charge, 30-year mounted mortgage factors and costs, and a median mortgage worth based mostly on the NAR median value and a 20% down cost.

2 Housing prices are burdensome in the event that they take up greater than 30% of revenue. The 25% share of mortgage cost to revenue takes under consideration that owners have further bills reminiscent of mortgage insurance coverage, dwelling insurance coverage, taxes, and bills for property upkeep.

3 A Dwelling Affordability Index (HAI) worth of 100 implies that a household with the median revenue has precisely sufficient revenue to qualify for a mortgage on a median-priced dwelling. An index of 120 signifies {that a} household incomes the median revenue has 20% greater than the extent of revenue wanted pay the mortgage on a median-priced dwelling, assuming a 20% down cost in order that the month-to-month cost and curiosity won’t exceed 25% of this degree of revenue (qualifying revenue).

4 Whole housing prices that embrace mortgage cost, property taxes, upkeep, insurance coverage, and utilities should not thought-about burdensome in the event that they account for not more than 30% of revenue.

5 The Mortgage Bankers Affiliation (MBA) that analyzes information from Ellie Mae’s AllRegs® Market Readability® enterprise info device. A decline within the MCAI signifies that lending requirements are tightening, whereas will increase within the index are indicative of loosening credit score.